by T.A. DeFeo

Georgia is rolling in the dough.

State officials said net tax collections for March exceeded $2.7 billion, an increase of $862.9 million, or 45.5%, over last March. So far this year, net tax collections topped $22.5 billion, an increase of nearly $3.6 billion, or 18.9%, compared to last fiscal year.

In a news release, state officials said the differences in tax filing deadlines in fiscal 2020, fiscal 2021 and fiscal 2022 are partly responsible for the revenue uptick.

Individual income tax collections increased by $657.9 million, or 70.6%, to nearly $1.6 billion.

Meanwhile, gross sales and use tax collections for March exceeded $1.2 billion, increasing $213.8 million, or 20.3%. Corporate income tax collections were nearly $204.9 million, increasing $71 million, or 53.1%.

Motor fuel tax collections increased by $12.6 million, or 8.8%. However, that number is expected to drop this month after Gov. Brian Kemp signed legislation last month to temporarily suspend the state’s tax on motor fuel sales in the face of high gas prices.

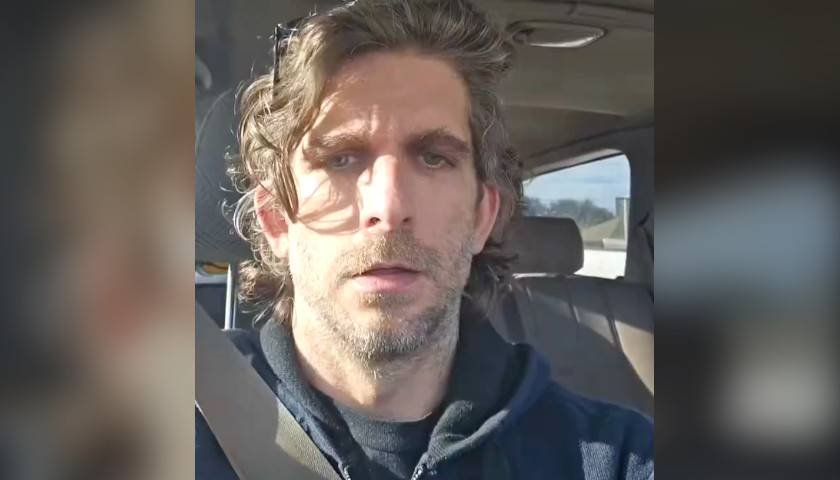

On Friday, Kemp took to Twitter to tout how the gas tax reduction has helped Georgians and criticize President Joe Biden.

“A month ago, I signed HB304 to temporarily suspend the state gas tax and help counter Biden-flation at the pump,” Kemp said in a Friday morning tweet. “This week, the price of an avg. gallon in GA was down 57 cents. We’ll keep doing our part to lessen the impact of failed policies on Georgians’ wallets.”

Democrats, however, said Republicans’ policies aren’t helping the middle class.

“While families struggle to make ends meet, the GOP wants to increase taxes on the middle class and use it to shower their corporate donors with tax breaks,” Georgia Democrats tweeted on Thursday. “It’s wrong, and we must stand against this in November.”

– – –

T.A. DeFeo is a contributor to The Center Square.

Photo “Brian Kemp” by Brian Kemp. Background Photo “Georgia State Capitol” by DXR. CC BY-SA 4.0.