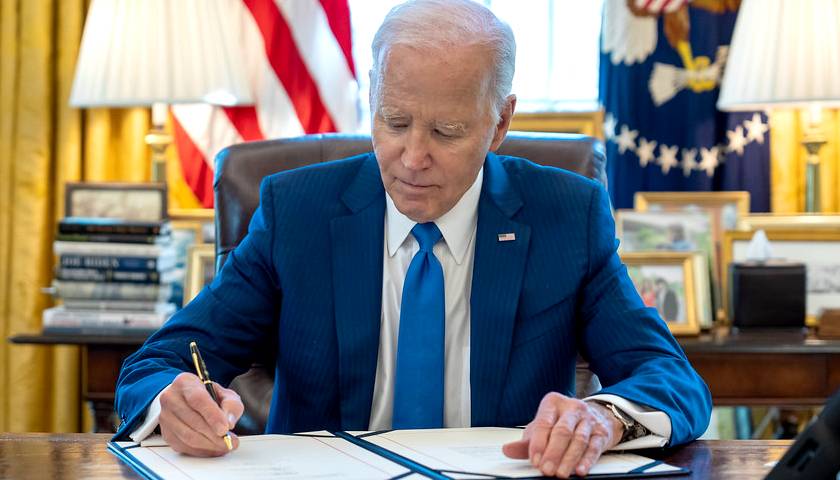

August came early to the nation’s capital with last week’s round of March inflation data. The late summer weather in Washington, D.C., is notoriously hot and sticky, two accurate descriptors of the latest price increases facing families and businesses alike. Inflation is stubbornly high, and the Biden administration’s spendthrift public policies are to blame.

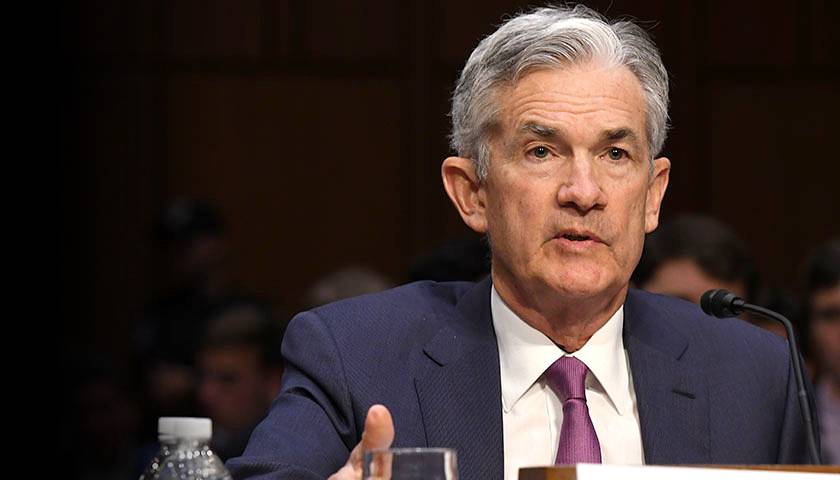

In the past 12 months, consumer prices rose 3.5 percent, the second month of accelerating annual inflation. In March alone, prices rose 0.4 percent. That may not sound like much, but it’s actually terrible. If that monthly inflation rate holds steady, prices will double in less than 16 years.

Read More