Former President Donald Trump said he would seek to use tariffs to potentially eliminate the income tax in a lengthy interview with podcaster Joe Rogan released Friday night.

Read MoreTag: tax

Commentary: Tax Armageddon Day Is Coming

Benjamin Franklin famously wrote in 1789 that “our new Constitution is now established and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes.” Death and taxes are fated. However, are enormous tax hikes also a fait accompli? Is it a certainty – ‘an accomplished fact’ – that the White House and Congress will repeal tax reforms that worked? Tax breaks that helped small business owners and families.

For the past several days Americans have been scrambling to make the deadline to complete their 2022 tax returns. Most taxpayers will be relieved once the ordeal is done. However, here’s an unfortunate reality: if Washington fails to act, the federal tax code is headed for major changes in just a couple of years, including massive tax hikes on families and small businesses.

Read MoreGeorgia’s Tax Collections Wane in March

Georgia’s net tax collections for March decreased by 3 percent from a year ago, new state revenue figures show.

While collections for the month surpassed $2.6 billion, the total was more than $82.7 million less than net tax collections a year ago.

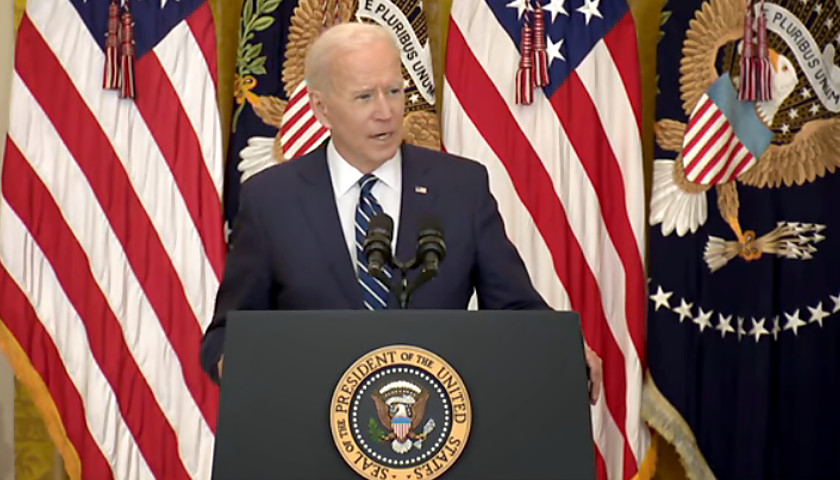

Read MoreBiden Signs $740 Billion Climate, Tax and Health Care Bill into Law

President Joe Biden signed a $740 billion spending package into law Tuesday, the final step for the green energy, health care and tax hike bill after months of wrangling and controversy, in particular over the legislation’s hiring of 87,000 new IRS agents to audit Americans.

Democrats at the White House Tuesday touted the bill’s deficit reduction of $300 billion over the next decade. The bill includes several measures, including a $35 per month cap on insulin copays, an extension of Affordable Care Act subsidies, and authorization for Medicare to negotiate certain drug prices.

Read MoreU.S. Senate Passes Massive Tax and Spend Bill Targeting Carbon Emissions, Prescription Drug Costs, More

The U.S. Senate on Sunday passed a $740 billion new taxing and spending bill that seeks to combat climate change and allow the government to control the price of prescription medications, among other things.

No Republicans voted for the bill, named the Inflation Reduction Act of 2022, in the divided 50-50 Senate, forcing Vice President Kamala Harris to break the tie. The measure must return to the House for a concurrence vote after senators passed several amendments Sunday. The House is expected to take the bill up again on Friday. If the House concurs, President Joe Biden has indicated he will sign it.

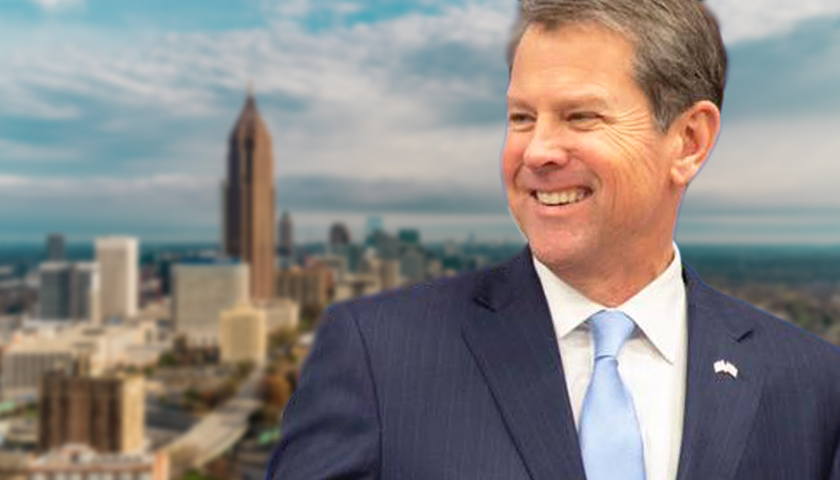

Read MoreKemp Signs Bill to Give Georgia Taxpayers a More than $1 Billion Refund

Georgia Gov. Brian Kemp signed a measure Wednesday to give a one-time tax refund to eligible Georgia taxpayers.

Taxpayers who are single or married and filing separately will receive a $250 refund under House Bill 1302. Heads of households will receive a $375 refund, while married taxpayers who file jointly will receive a $500 refund.

The Georgia Department of Revenue will credit taxpayers with the refund once they file their 2021 taxes, which are due April 18. Taxpayers who already have filed their 2021 taxes will receive a refund based on what they indicated on their tax returns.

Read MoreIRS Looks to Hire 10,000 Workers in Attempt to Resolve Tax Return Backlog

The Internal Revenue Service is hiring 10,000 employees as part of an attempt to address a backlog of nearly 24 million tax returns, most of which are outstanding from the 2020 tax season.

Read MoreManchin Objects to Dems’ Billionaire Tax, Saying They ‘Create a Lot of Jobs’

West Virginia Democratic Sen. Joe Manchin came out against his party’s plan to tax billionaires in order to finance their social-spending package just hours after it was first released.

“I don’t like it. I don’t like the connotation that we’re targeting different people,” Manchin told reporters Tuesday morning, describing billionaires as people who “contributed to society and create a lot of jobs and a lot of money and give a lot to philanthropic pursuits.”

Read MoreBusinesses Push Back Against Biden Plan to Track All Bank Transactions over $600 Through the IRS

A major component of President Joe Biden’s plan to raise revenue to pay for his trillions of dollars in new federal spending is now under fire from trade associations across the country.

The Biden administration has made clear its plan to beef up IRS auditing by expanding the agency’s funding and power. Biden’s latest proposal would require banks to turn over to the Internal Revenue Service bank account information for all accounts holding more than $600.

In a sharp pushback against the proposal, more than 40 trade associations, some of which represent entire industries or economic sectors, signed a letter to U.S. House Speaker Nancy Pelosi, D-Calif., and Minority Leader Kevin McCarthy, R-Calif., raising the alarm about the plan.

Read MoreFarmers Cry Foul over Biden’s Death Tax Proposal

President Joe Biden has proposed amending the inheritance tax, also known as the “death tax,” but farmers around the country are raising concerns about the plan.

In the American Families Plan introduced earlier this year, Biden proposed repealing the “step-up in basis” in tax law. The stepped-up basis is a tax provision that allows an heir to report the value of an asset at the time of inheriting it, essentially not paying gains taxes on how much the assets increased in value during the lifetime of the deceased. This allows heirs to avoid gains taxes altogether if they sell the inheritance immediately.

Under Biden’s change, heirs would be forced to pay taxes on the appreciation of the assets, potentially over the entire lifetime of the recently deceased relative.

Read MoreRepublicans Push Back Against ‘Politicization’ of IRS

President Joe Biden has pushed for beefing up IRS audits of corporations to raise revenue for his new spending proposals, but Republicans are raising the alarm about the potential consequences of the plan.

Biden unveiled his “Made in America Tax Plan” earlier this year as a strategy to help fund his trillions of dollars in proposed new federal spending that includes several tax hikes. Despite this, a bipartisan coalition in the U.S. House and Senate have agreed to a basic framework for Biden’s proposed infrastructure plan, but one element has been the theme of the negotiations among Republicans: no new taxes.

The GOP pushback against raising taxes, though, puts more pressure on the Biden administration to find ways to fund his agenda. Aside from Biden’s controversial tax hike proposals, the president also has proposed adding $80 billion in funding to the IRS so it can increase audits of corporations.

Read MoreCritics of Biden’s Proposed Oil-and-Gas Industry Taxes Fueled by Gas Shortages

Gas shortages on the East Coast have helped rally Congressional opposition to the portions of President Joe Biden’s infrastructure plan that would force oil and gas companies to pay more in taxes.

House Republicans sent a letter to House Speaker Nancy Pelosi, D-Calif., and House Majority Leader Steny Hoyer, D-Md., calling on Democrats to oppose Biden’s plan to “eliminate tax preferences for fossil fuels.”

The letter, signed by 55 Republicans, came after a cyber attack of Colonial Pipeline shut down a major pipeline on the East Coast and led to fear-driven gasoline shortages. The attack also raised questions about the nation’s energy infrastructure and vulnerability to attack.

Read MoreGeorgia House Passes on Effort to Study State’s Tax, Revenue Structure

The Georgia House has rejected a bill that would have launched a review of the state’s revenue and tax structure.

Senate Bill 148 would have created two panels to study and make recommendations for the state’s coffers. It would have re-established the Special Council on Tax Reform and Fairness for Georgians and create the Special Joint Committee on Georgia Revenue Structure.

The House voted, 139-20, against the bill Thursday. It had 39 sponsors.

Read More