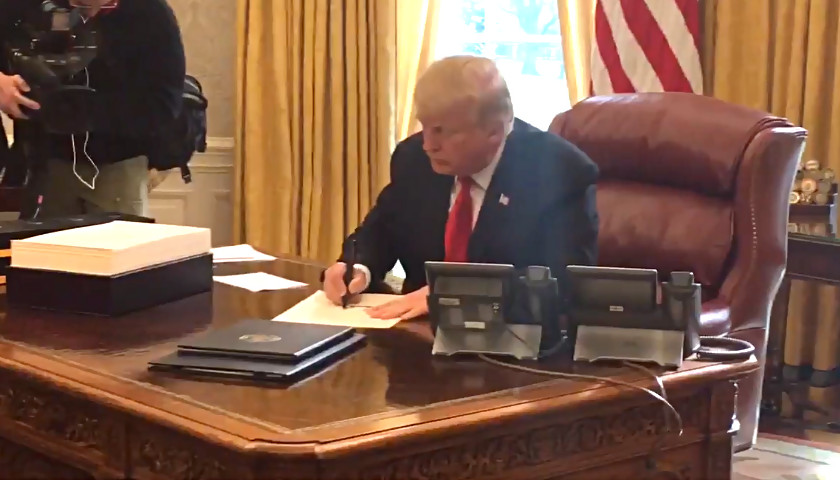

We did it.

The greatest comeback in political history, President Donald Trump taking back the office he held four years ago, is historic and nothing short of remarkable. The message it sends is that “Make America Great Again,” the MAGA movement, is here to stay. Long gone are the days of the old GOP establishment, the controlled opposition that had no problem managing the decline of the nation along with the Democrats. Now, Americans are no longer the forgotten men and women. We are ascendant, and we must make sure that our party will continue this path for the foreseeable future.

Read More