by Casey Harper

Several Republicans in the U.S. House and Senate sent a letter to the IRS Friday demanding the agency correct a ruling they say could have major implications for churches and faith-based organizations in the U.S.

Fifteen members signed the letter to IRS Commissioner Charles Rettig about a Christian group in Texas called Christians Engaged. The group released a letter from the IRS stating that the federal tax agency denied the group 501(c)(3) nonprofit status, saying “Bible teachings are typically affiliated with the [Republican] party and candidates.”

That line of reasoning has sparked significant controversy.

“These issues have always been at the core of Christian belief and classifying them as inherently political is patently absurd,” the Republican letter reads. “If the IRS applied this interpretation broadly, it would jeopardize the tax-exempt status of thousands of Christian churches around the country.”

Christians Engaged works to get Christians more active in government. They are challenging the IRS’ denial. Now, they have the support of several members of Congress, whose Friday letter accuses the IRS of “political biases.”

“We write today to express extreme concern regarding a recent Internal Revenue Service (IRS) determination on the tax-exempt status of Christians Engaged, a nonprofit organization located in Texas,” the letter says. “We urge you to personally review this determination, and remove the individual, or individuals, responsible for the blatantly biased, discriminatory, and flawed reasoning that led to the determination.”

Sens. Ted Cruz, R-Texas, Marco Rubio, R-Fla, and Mike Lee, R-Utah, signed onto the letter, which goes on to call for the firing of the IRS employees responsible for the decision.

“The IRS must objectively analyze applications for tax-exempt status and cannot allow political biases to creep into its decisions,” the letter says. “We urge you to immediately review Christians Engaged’s application for 501(c)(3) status personally, and terminate the IRS staff involved in the flawed and politically motivated reasoning behind the determination.”

The IRS has not yet responded to the letter.

Christians Engaged incorporated in 2019 as a nonprofit in Texas. The group’s mission is “nonpartisan religious and civic education, focusing on encouraging and educating Christians to be civically engaged as a part of their religious practice.”

“The recent determination on Christians Engaged’s tax-exempt status further exposed the corruption and liberal bias running rampant at the IRS,” said Rep. Chip Roy, R-Texas. “This discriminatory action against a Christian nonprofit is an overt attack on religious liberty by a tyrannical federal government. Moreover, this decision comes at a time when members of both parties are trying to increase the ability of the IRS to harass individual Americans, businesses, and organizations.”

The controversy comes at a time when President Joe Biden has advocated for expanding the IRS to allow for more aggressive auditing in an attempt to raise revenue for his spending plans.

“Commissioner Rettig must review this decision and hold accountable the IRS staff involved, and rather than expand the IRS’s power, as the new infrastructure deal proposes, we should abolish it,” Roy said.

The IRS came under heavy fire during the Obama administration for targeting conservatives in the Tea Party. Republicans Friday alluded to that treatment in their concern about this latest case.

“Religious institutions should not be punished for their fundamental Judeo-Christian values. I am deeply concerned that the IRS is once again being weaponized against everyday Americans,” said Rep. Doug Lamborn, R-Colo. “Their latest attempt to remove tax-exempt status from Christians Engaged sends a chilling warning that Americans’ First Amendment rights are under siege. We cannot allow any political bias at the IRS.”

Other critics lumped the issue in with other key lines of attack against the Biden administration in recent weeks.

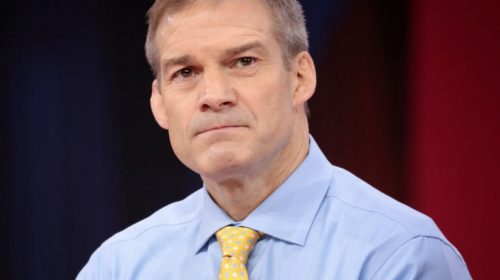

“Biden/Harris IRS targets conservatives,” Rep. Jim Jordan, R-Ohio, wrote on Twitter. “Biden/Harris DOJ sues Georgia for voting laws. Biden/Harris DHS ignores the border crisis. And now Democrats in Congress want to give the Biden/Harris FTC more unchecked powers. Bad!”

– – –

Casey Harper is a Senior Reporter for the Washington, D.C. Bureau of The Center Square. He previously worked for The Daily Caller, The Hill, and Sinclair Broadcast Group. A graduate of Hillsdale College, Casey’s work has also appeared in Fox News, Fox Business, and USA Today.

Why 501(c)4 groups should be freely allowed and encouraged:

The question should be: How and why should any government level be able to tax any part of political free speech? It ain’t free if government is taking a cut and regulates through its taxing power. If you have to bend to their will and jump through their hoops to say what you will, then what you say is not yours to freely utter. More so, when you have to promise not to picket another group like some conservative applicants were told regarding Planned Parenthood. The power to tax is not only the power to destroy but the power to curtail and modify. That alone is an abridgment of the 1st Amendment. Note that hardly anyone will donate or fund an advocacy campaign group subject to their donation going up to 35% to the entity they are advocating reducing. Taxable status, or uncertainty of it, is the kiss of death to an advocacy organization’s funding and thus its being.

Just make the church a union.

Which came first, Christianity or the GOP? It is patently obvious that the GOP has oriented toward Christianity, not the church to the party. It’s just another fascist/Marxist oppressive act.

What about black churches that are almost exclusively pushing the Democratic Party line and have been for decades? A typical hash by the feds.