The State of Texas has been a leader in the pushback against environmental, social and governance (ESG) policies, passing some of the first anti-ESG laws in the country. Last week, Texas Attorney General Ken Paxton moved to protect the coal industry from what Paxton says is an effort on the part of large investment firms to not only shrink coal companies — but also unfairly profit from them.

Read MoreTag: BlackRock

State AGs Sue Three of the World’s Biggest Asset Managers for Allegedly Violating Antitrust Laws

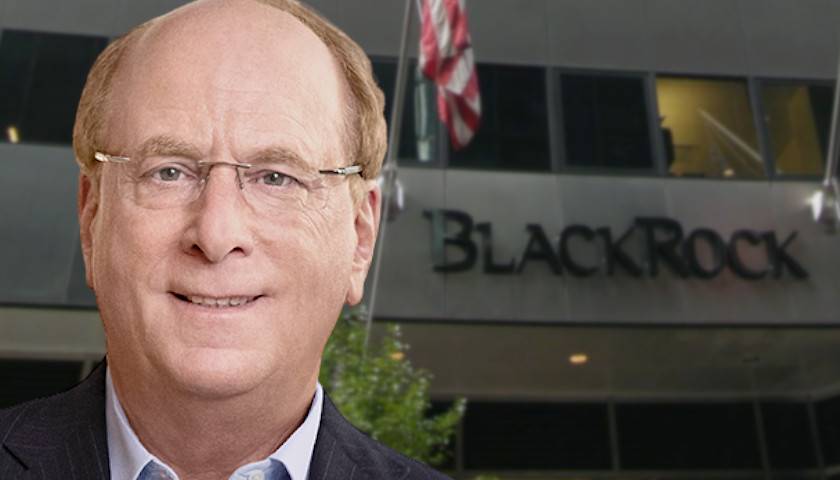

Texas Attorney General Ken Paxton is leading 10 other GOP state attorneys general in a lawsuit against BlackRock, State Street Corporation and Vanguard Group, three of the largest asset managers worldwide, for allegedly violating antitrust laws.

The firms allegedly conspired to use anticompetitive trade practices to artificially constrict the coal market, according to Paxton’s office. They acquired substantial stockholdings in all significant, publicly held coal producers in the U.S., allowing them to have the power to control coal company policies. These asset managers pushed for reduced coal output by more than half by 2030.

Read MoreInvestment Giants Leveraged Texas Universities’ Endowment Funds to Back Anti-Oil Agenda, Report Finds

Several asset managers leveraged two major Texas university systems’ endowment funds to advance anti-fossil fuel shareholder proposals in 2022 and 2023, according to a report from the conservative watchdog group American Accountability Foundation (AAF).

BlackRock-owned Aperio Group, Cantillon, former Vice President Al Gore-chaired Generation Investment Management, GQG Partners and JP Morgan Asset Management collectively manage approximately $4 billion for The University of Texas/Texas A&M Investment Management Company (UTIMCO) as of July, which handles the university systems’ endowments.

Read MoreMajor Beer Company Becomes Latest to Scrap Diversity Policies

Molson Coors announced Tuesday it would walk back a number of its diversity, equity and inclusion (DEI) policies, joining a number of other major U.S. corporations that have revoked such practices this summer.

The company will ensure “executive incentives” are not tied to meeting “representation” targets, end its participation in the Human Rights Campaign’s (HRC) Corporate Equality Index and axe its “supplier diversity” efforts, according to a memo obtained by the Daily Caller News Foundation. Several other companies have taken similar measures, including home improvement retailer Lowe’s and Ford Motors.

Read MoreWoke 2.0: ESG Critics Say the Same Movement Marches on, Only with a New Name

BlackRock began renaming environmental, social and governance (ESG) earlier this year. It’s now calling it “transition investing.”

The company recently updated its climate and decarbonization stewardship guidelines. The document makes no mention of ESG, but it shows in many ways, the world’s largest investment manager with $10 trillion in assets under management is still pursuing many of the same goals.

Read MoreFormer Blackrock Adviser Argues at Energy Forum that Divesting from Oil and Gas is Not Sustainable

The environment, social and governance (ESG) investing movement has faced a lot of criticism over the past couple years for undermining fiduciary responsibility and pushing progressive agendas through an undemocratic process.

At the Energy Future Forum presented by RealClearEnergyWednesday, Terrence Keeley, author and former senior advisor at Blackrock, argued that ESG is also misallocating resources and doing nothing for the environment it claims to protect.

Read MoreTexas Schools Pull $8.5 Billion from BlackRock over ESG

The Texas Permanent School Fund (PSF) is pulling $8.5 billion from the investment firm BlackRock over its use of environmental, social and governance (ESG) policies.

The board informed the investment firm that it was being terminated as the manager of the Navarro 1 Fund in a Tuesday letter, which it provided to the Daily Caller News Foundation. The divestment represents the largest from the private firm, according to Fox Business Network.

Read MoreLawmakers Aim to Ban Colleagues from Market Trading While They Still Buy and Sell

Four members of Congress recently reported buying and selling financial assets, despite co-sponsoring a bill that would ban such trades, disclosures show.

Democratic Reps. Mary Gay Scanlon of Pennsylvania, Jeff Jackson of North Carolina, Bill Keating of Massachusetts and Republican Rep. Pete Sessions of Texas all reported selling or purchasing assets after they signed on as co-sponsors of the TRUST In Congress Act, financial disclosures show. The TRUST In Congress Act would ban members of Congress from directly trading covered investments, which includes securities, commodities futures and similar assets by requiring them to place such assets in a blind trust.

Read MoreBlackRock to Make Massive Infrastructure Move to ‘Decarbonize the World’ and Reap Government Subsidies

BlackRock on Friday reached an agreement to acquire Global Infrastructure Partners for $12.5 billion, a move aimed at advancing the investment giant’s climate objectives and capitalizing on government subsidies, according to statements and reports.

BlackRock is the world’s largest asset manager and is a proponent of environmental, social and corporate governance (ESG) investing. Both companies share a commitment to decarbonization and BlackRock sees the deal’s timing as opportune, as governments have offered businesses rare financial incentives to build infrastructure, including for green energy projects, according to a press release.

Read MoreRep. Jim Jordan Subpoenas Major Investment Firms for Evidence on ESG Collusion

House Judiciary Committee Chairman Jim Jordan on Friday subpoenaed two major players in the investment world for evidence in his investigation into Wall Street efforts to impose the liberal climate doctrine known as Environmental Social Governance or ESG and force carbon out of corporate America.

The subpeonas to BlackRock and State Street Global Advisers come months after Jordan made written requests for documents detailing how BlackRock pushed ESG policies in the investment world. Jordan said while his committee got some responsive materials from the two firms, he believes more is warranted.

Read MoreNikki Haley Meets with BlackRock CEO Larry Fink, Other Wall Street Elites

Former U.N. Ambassador Nikki Haley met with several Wall Street executives in a series of events Tuesday in her bid to be the Republican nominee for president, according to the Financial Times.

Haley attended a small meet-and-greet breakfast in New York where CEO of BlackRock Larry Fink was in attendance, followed by a fundraiser later in the day co-hosted by Gary Cohn, former president of Goldman Sachs, according to the FT. BlackRock has been criticized by conservatives in recent years for its adoption and promotion of Environment, Social and Corporate Governance (ESG) policies, which aim to invest in companies based on their commitment to social and environmental causes.

Read MoreCommentary: Rumors of ESG’s Demise Are Greatly Exaggerated

Consumer and Republican backlash against Environmental, Social and Governance (ESG) investments has increased dramatically in the past year as states, Congress and presidential candidates have taken on the issue, promising to rein in the largely green-conscious movement of capital amid spiraling energy and food costs since 2021.

Boycotts of brands such as Bud Light, Disney and Target, coupled with statements by Blackrock CEO Larry Fink that he no longer wanted to call these so-called sustainable investments ESG— at Aspen Ideas Festival on June 25 Fink said “I’m not going to use the word ESG because it’s been misused by the far left and the far right… we talk a lot about decarbonization, we talk a lot about governance … or social issues, if that’s something we need to address…”—and reported outflows from ESG funds in 2023 have painted a gloomy picture for green and socially conscious investing.

Read MoreWall Street Firms That Sold Out to China Are Now Struggling

Major Wall Street firms that decided to expand their asset management operations into China are struggling to capitalize on the market, according to The Wall Street Journal.

BlackRock, a top U.S. investment company, is one of many American firms that are struggling to compete in the Chinese market, ranking only 145th out of almost 200 Chinese mutual funds, with other firms like Fidelity International and Neuberger Berman ranking even lower, according to the WSJ. Factors contributing to the firm’s woes are a lack of willingness from local companies to utilize American investment banks, a struggling Chinese economy and restrictions from both the U.S. and China.

Read MoreCommentary: BlackRock and Its ESG ‘Voting Choice’ Ruse

Amid growing criticism of its environmental, social and governance (ESG) investment practices, BlackRock has announced that it will offer retail investors in its largest exchange-traded fund (ETF) the opportunity to participate in its “Voting Choice” program. Open to institutional clients since January 2022, this program allows investors to choose from a limited set of options to guide BlackRock in voting their shares. While perhaps an effective PR tool, Voting Choice is little more than a ruse that neither empowers investors nor diminishes BlackRock’s power to impose its ESG goals on American businesses.

Read MoreAmerican Financial Titans Are Straying from Green Investment Strategies as GOP Pushback Mounts, Report Finds

Several leading American asset managers have decreased their support for environmental, social and governance (ESG) resolutions since 2021, according to a new report by InfluenceMap, a nonprofit that tracks climate policies in Western corporations.

InfluenceMap’s report assigned BlackRock, Vanguard, State Street and Fidelity environmental stewardship grades of C+ or lower, which indicates that each firm exhibits “a lack of effective climate stewardship processes and use of shareholder authority to engage companies to transition” to a green energy, net-zero carbon emissions future. The report also noted that 2022 saw a “considerable” drop in corporate support for ambitious green shareholder resolutions, a development that coincides with increased Republican scrutiny of corporate ESG policies and mandates.

Read MoreCommentary: Does Anyone Buy That the Head of BlackRock Is ‘Ashamed’ of ESG?

The big news in energy this week is that BlackRock CEO Larry Fink says he is no longer using the term “ESG” in his business communications. Even more, Mr. Fink is now “ashamed” to be a participant in the debate on the issue. At least, that’s what he initially said on Sunday to an audience at the Aspen Ideas Festival, where he was a speaker.

“I’m ashamed of being part of this conversation,” Fink said as quoted by Axios. But almost as soon as he made the admission, Fink took it all back when pressed by his session’s moderator. “I never said I was ashamed,” he said, even though he had just actually said that very thing. “I’m not ashamed. I do believe in conscientious capitalism.”

Read MoreBlackRock Recruiter Says $10k ‘Can Buy a Senator,’ Calls Ukraine War ‘Good for Business’: Video

A recruiter for BlackRock said that the asset management firm is able to “buy a senator” for $10,000 and that Russia’s invasion of Ukraine is “good for business,” according to a video recorded by an undercover journalist.

“You could buy your candidates. First, there is the senators. These guys are f***ing cheap. Got 10 grand? You can buy a senator. I’ll give you 500k right now. It doesn’t matter who wins, they’re in my pocket,” BlackRock Recruiter Serge Varlay said in a video published Tuesday by the O’Keefe Media Group, which was founded by guerilla journalist James O’Keefe.

Read MoreBlackRock’s Board Fends Off Climate Proposals from Left-Wing Shareholders at Annual Meeting

Investing giant BlackRock’s board of directors recommended voting against two climate report proposals at its annual shareholder meeting on Wednesday, and investors followed the firm’s advice.

Each proposal demanded reports from BlackRock; left-wing activist organization CODEPINK requested a report from BlackRock concerning the climate-related risks of its aerospace fund. Paul Rissman, co-founder of Rights CoLab and a fellow for the George Soros-founded Open Society Foundations, requested a report on engineering decarbonization and its impact on pension fund returns; BlackRock’s board of directors recommended voting against both because the firm argued they do not provide the best results for shareholders.

Read MoreCommentary: The Great Carbon Capture Scam

Carbon capture is like burning witches.

In the 15th to 17th centuries, the elite in Europe and the United States believed that “evil humans were negatively affecting the climate and weather patterns.” The people were demanding something — anything — be done about famine and crop failure. There must be consequences, facts be damned, so inconvenient women on the fringes of society were labeled “witches” and burned at the stake in droves.

Read MoreCommentary: BlackRock’s Larry Fink and the New Post-ESG Realism

As regular as the turn of the seasons, each January sees Larry Fink, founder and CEO of BlackRock, the world’s largest asset manager, publish a lengthy letter on the state of the world and its implications for finance and investors. This year, January turned to February, and still no letter. Instead, February saw Tim Buckley, CEO of Vanguard, global number-two asset manager, give a groundbreaking interview explaining Vanguard’s decision late last year to quit the Net Zero Asset Managers (NZAM) initiative, which had been formed ahead of the 2021 Glasgow climate conference to reallocate capital in line with net zero emissions targets.

Read MoreBlackRock CEO Scales Back Emphasis on Climate Investing: Not the Environmental Police

CEO Larry Fink of investing titan BlackRock put reduced emphasis on climate and other environmental, social and governance (ESG) goals in an annual letter to the company’s investors and stakeholders Wednesday, amid Republican criticism of his firm’s investing strategy.

BlackRock has faced significant criticism from Republicans, who allege that the company has focused too much on “woke” investing to the detriment of its clients, and more recently Democrats who argue the company hasn’t gone far enough with its ESG efforts. Fink’s reduced emphasis on his firm’s role in the energy transition stands in stark contrast to his 2020 letter to investors, in which he argued the company had a “significant responsibility … to play a constructive role” in the transition to low-carbon sources of energy, Axios reported.

Read MoreCommentary: 2022 Is the Year ESG Fell to Earth

The year 2022 brings an end to an era of illusions: a year that saw the end of the post–Cold War era and the return of geopolitics; the first energy crisis of the enforced energy transition to net zero; and the year that brought environmental, social, and governance (ESG) investing down to earth with a thump—for the year to date, BlackRock’s ESG Screened S&P 500 ETF lost 22.2% of its value, and the S&P 500 Energy Sector Index rose 54.0%. The three are linked. By restricting investment in production of oil and gas by Western producers, ESG increases the market power of non-Western producers, thereby enabling Putin’s weaponization of energy supplies. Net zero—the holy grail of ESG—has turned out to be Russia’s most potent ally.

Read MoreMissouri Withdraws Half a Billion Worth of Pension Funds from BlackRock’s Control

Missouri State Treasurer Scott Fitzpatrick announced on Tuesday that the state’s pension fund is selling all of its assets that are managed by BlackRock, a move that will divest up to $500 million from the asset manager.

The Missouri State Employees’ Retirement System (MOSERS) is withdrawing its assets from BlackRock’s control because the state believes that the company is using its control of pension funds to push a “left-wing” agenda as opposed to making money for its clients, according to a press release. Missouri joins several other Republican-run states that have also pulled funds from BlackRock for similar reasons.

Read MoreBlackRock Stock Downgraded over Investments in ESG

The asset management company BlackRock, which has been widely criticized for promoting multiple far-left concepts in the world of business, has seen its stock downgraded due to ongoing backlash.

According to The Daily Wire, UBS analyst Brennan Hawken downgraded the company last week due to its support for Environmental, Social, and Corporate Governance (ESG) policies. The target stock price was reduced from $700 to just $585, resulting in a one percent drop in BlackRock shares on Tuesday.

Read MoreRepublican Treasurers Pull $1 Billion from BlackRock over Alleged Anti-Fossil Fuel Policies

Republican state treasurers are withdrawing $1 billion in assets from BlackRock’s control due to the asset manager’s alleged boycott of the fossil fuel industry, according to the Financial Times.

Republican South Carolina State Treasurer Curtis Loftus is pulling $200 million from BlackRock by the end of 2022, and Louisiana treasurer John Schroder said on Oct. 5 that he is divesting $794 million from the company, according to the FT. Utah treasurer Marlo Oaks said he removed $100 million in funds from BlackRock’s control, and Arkansas treasurer Dennis Milligan pulled $125 million from the company in March.

Read MoreBlackRock CEO Hails High Energy Prices for ‘Accelerating’ Green Transition

BlackRock CEO Larry Fink said during a forum at the Clinton Global Initiative that increased energy prices are “accelerating” the transition to “green” energy.

“Because of the rising energy prices, we are certainly seeing the green premium shrink quite considerably. And so, the amount of investment dollars that are going into new decarbonization technology is accelerating, and accelerating very rapidly,” Fink told former President Bill Clinton.

Read MoreBlackRock Scrambles to Clarify Stance on Climate-Focused Investing

The world’s largest asset manager, BlackRock, responded to more than a dozen Republican attorneys general explaining its approach to environmental, social and corporate governance (ESG) investing after the attorneys general alleged that the company is violating its fiduciary duties, according to a company letter.

Read More‘Socialism in Sheep’s Clothing’: Pro-Market Leaders Combat ESG, Liberal Capture of Corporate America

Pro-market elected officials and thought leaders are fighting back against progressive activists’ creeping capture of corporate America through the Environmental Social and Governance movement..

ESG investment strategies, increasingly prevalent among large asset management firms, seek to leverage passive investors’ assets to steer corporate decision-making to promote progressive social and environmental priorities. ESG has often been compared to the “social credit” system used by China’s ruling communist elite to enforce political conformity on its population.

Read MoreTexas Bans BlackRock for Anti-Oil Agenda

The state of Texas announced new restrictions on at least 10 finance firms that have declared an opposition to oil and other fossil fuels, since such a stance could “undermine” the Texas economy that depends heavily on such fuel sources.

The Daily Caller reports that the restrictions, announced by the Texas Comptroller of Public Accounts Glenn Hegar, will prevent the companies in question from entering into most contracts with entities at the state or local level. The new policy is the result of a law passed in 2021 that requires the state government to limit its ties with anti-oil companies. As a result, the government requested information from over 100 companies to determine their stances on fossil fuels.

Read MoreConsumers’ Research Says BlackRock Abdicating Fiduciary Responsibility in Favor of Progressive Politics

A research group has honed in on investment titan BlackRock, known for purchasing real estate in massive swaths nationwide, saying that those who have invested in the company may be at risk.

Consumer’s Research says:

Read More‘May Violate Multiple State Laws’: Republican AGs Demand BlackRock Answer for Pushing ESG on State Pension Funds

Missouri Attorney General (AG) Eric Schmidt and 18 other Republican AGs are investigating BlackRock concerning the company’s push to place environmental, social and corporate governance (ESG) standards on states’ pension funds, according to the AGs’ letter.

The Republican AGs, including those from Arizona, Texas, Ohio and Montana, sent a letter to BlackRock CEO Larry Fink on Thursday claiming that BlackRock did not attempt to make money for states’ pensioners, but rather used funds to pressure companies to phase-out fossil fuels and comply with its climate agenda. The AGs allege that numerous of the firms’ actions ‘may violate multiple state laws’ as BlackRock may have an ulterior motive, particularly concerning its “climate agenda,” that differs from its public stances and statements.

Read MoreUPS to Invest $8.75 Million in Atlanta Organizations in ESG Effort

At the inaugural UPS Impact Summit, the shipping company announced they will invest $8.75 million in Atlanta companies in a pledge to advance “ESG [environmental, social and justice agenda], diversity, equity and economic empowerment.”

“UPS is a purpose-driven company. We move goods while also doing good — this is who we are in our hometown and in every community we serve,” UPS Chief Executive Officer Carol B. Tomé said. “I’m proud of our Foundation’s approach to driving social impact here in Atlanta and around the world.”

Read MoreCommentary: BlackRock’s Stakeholder Capitalism for Thee, Not for Me

Blackrock has gone from being known as the largest asset manager in the world to being known as the investment company that pushes a social agenda on the companies it invests in. From cajoling corporate America into signing the manifesto of stakeholder capitalism, the Business Roundtable Statement on Corporate Responsibility, to putting anti-oil board members on the board of oil companies, Blackrock has developed a reputation, at least among conservatives, as a company that is imposing CEO Larry Fink’s social agenda on American capitalism.

In fact, the reputational issue is so prevalent that Fink spent much of the recent annual report rebutting it, arguing that what he is practicing is simply capitalism and that the imposition of climate change minimization measures and other ESG issues relevant to stakeholders is simply capitalism. The standard arguments here are that practicing ESG is not politics but rather risk management. Typically ESG proposals talk about reputational risk or the risk that at some point in the future governments will embrace the values expressed in ESG circles and impose them involuntarily on businesses. In such cases, for example, fossil fuel companies will be stuck with “stranded assets”, i.e. oil and gas wells rendered worthless by the coming age of enlightened energy regulation.

Read MoreStates Preemptively Banning ESG Practices Pushed by Big Capital

States across the country are preemptively banning Environmental, Social and Governance (ESG) scoring, which some say would lead to a massive consolidation of wealth among the most powerful investment companies in America.

“In an attempt to secure vast amounts of wealth and influence over society, corporations, bankers, and investors, working closely with key government officials, have launched a unified effort to impose environmental, social, and governance (ESG) standards on most of the industrialized global economy. (ESG standards are also referred to as ‘sustainable investment’ or ‘stakeholder capitalism.’),” Justin Haskins at The Heartland Institute said.

Read MoreBig Capital’s Social Justice ESG Bills Soar Through State Legislatures

Just months after The Star News Network reported on Environmental, Social and Governance (ESG) scores taking over corporate America, bills are pouring into state legislatures around the country, some with the intent on implementing the practice and others with the intent of banning the practice.

Justin Haskins at The Heartland Institute, which has closely tracked ESG scores, defines them as the following:

Read MoreAnalyses of CDC Data Show Massive Spike in Excess Mortality in Millennials After Vaccine Mandates

Former BlackRock Portfolio Manager and Investor Edward Dowd is accusing the United States government of democide after an analysis of Centers for Disease Control (CDC) data showed an 84 percent increase in excess mortality in millennials in the fall of 2021.

During a recent appearance on Steve Bannon’s War Room Pandemic, Dowd said that an insurance industry expert analyzed the CDC’s aggregate data and broke down the number of mortalities by age and created baselines for each age group. All age groups experienced excess mortality, especially millennials, he said.

Read MoreSchweizer: The Titans of Wall Street Are Among China’s Closest American Allies

TRANSCRIPT: McCabe: One of the great ironies in investigative journalist Peter Schweizer’s new book Red-Handed is the degree to which the Chinese Communist Party has infiltrated the very heart of American capitalism on Wall Street. Schweizer told The Star News Network that the titans of Wall Street are among China’s…

Read MoreCommentary: BlackRock CEO Larry Fink’s Woke Capitalism Crusade Runs into Resistance

Only a few years after “woke capitalism” was touted as the wave of the future, its supporters are getting a wakeup call of their own.

Just ask BlackRock CEO Larry Fink. The tone of his 2022 letter to CEOs is very different from his previous two, both of which pushed Environmental, Social and Governance (ESG) investment criteria and “stakeholder capitalism” relentlessly. As far as Fink was concerned, ESG, “sustainability,” and the agenda for what we have termed “woke capital” would dominate the markets for years, while he and his $10 trillion asset management behemoth would, in turn, dominate them. Fink was to be king of the stakeholder world.

Read MoreSchweizer: BlackRock CEO Larry Fink, Other Wall Street Leaders Partner with Chinese Coal, Military Enterprises

The investigative journalist and author of Red-Handed: How American Elites Get Rich Helping China Win told The Star News Network the titans of capitalism on Wall Street are now the partners of the Chinese Communist Party.

“What China wants from Wall Street is access to Western capital with no questions asked, and unfortunately the biggest fans on Wall Street are prepared to give it to them,” said Peter Schweizer, who is the president and founder of the Government Accountability Institute and the host of The Drill Down podcast.

Read MoreCommentary: Woke Capital Won’t Save the Planet – but It Will Crash the Economy

Judged by BlackRock CEO Larry Fink’s latest letter, January 2022 might turn out to be the highwater mark of woke capitalism. Stakeholder capitalism is not “woke,” Fink says, because capitalism is driven by mutually beneficial relationships between businesses and their stakeholders. He’s right. What Fink describes is capitalism pure and simple, the stakeholder modifier adding nothing to the uniqueness of capitalism in harnessing competition and innovation for the benefit of all.

Fink’s shift is more than rhetorical. Just three years ago, in his 2019 “Profit and Purpose” letter, Fink told CEOs that the $24 trillion of wealth Millennials expect to inherit from their Boomer parents meant that ESG (environment, social, governance) issues “will be increasingly material to corporate valuations.” Now Fink tells them that “long-term profitability” is the measure by which markets will determine their companies’ success, dumping the ESG valuation metrics he’d previously championed.

Read More