The State of Texas has been a leader in the pushback against environmental, social and governance (ESG) policies, passing some of the first anti-ESG laws in the country. Last week, Texas Attorney General Ken Paxton moved to protect the coal industry from what Paxton says is an effort on the part of large investment firms to not only shrink coal companies — but also unfairly profit from them.

Read MoreTag: environmental social and governance

ESG Initiatives Go Beyond Investment Banks to Include Biden Initiatives, Digital Content

Though well known by now that Environmental, Social and Governance metrics have become integral to U.S. business operations, the World Economic Forum is also advocating for ESG principles, but in a distinctive manner.

The international non-governmental organization, think tank, and lobbying organization based in Geneva recently released a white paper titled “Making a Difference: How to Measure Digital Safety Effectively to Reduce Risks Online.”

Read MoreExxon Shareholder Meeting Will Be a Battleground Between Climate Activists and ESG Opponents

A vote during the ExxonMobil 2024 shareholder meeting Wednesday will pit those who think an oil company should act according to the concerns of climate activists against those who think companies should act to produce the best investment returns for their shareholders.

It is the latest front in the growing fight between proponents and opponents of environmental, social and governance (ESG), as the movement struggles to maintain the clout to effect social change through investments.

Read MoreInvestment Standards Debate Moves into State Legislatures

Environmental, social and governance (ESG) investment standards are a hot topic among Republican lawmakers across the U.S. who see it as a political move to force a progressive agenda.

Democrats, on the other hand, see it as a smart investing strategy.

Read MoreInvestors and Activists Fight to ‘Depoliticize’ America’s ‘Radically Left-Wing’ Corporations

Center/right groups are gaining ground in pushing corporations back to the center, representatives for the investors and activist organizations told the Daily Caller News Foundation.

These center/right investors and activists are fighting back against diversity, equity and inclusion (DEI) and environmental, social and governance (ESG) policies that do not provide the best returns for investors, and result in discrimination, according to the groups who spoke to the DCNF. The groups do not want to impose their political beliefs on corporations, but rather want them to simply stop adopting policies they consider radical, they said.

Read MoreRon DeSantis Rips Right-Wing ‘Corporatists’ in Call to Crack Down on Big Business

Republican Gov. Ron DeSantis of Florida fired back at Republican critics of his efforts to rein in big businesses, calling them “corporatists.”

DeSantis signed legislation May 2 that prohibited state agencies and local governments from considering Environmental, Social and Governance (ESG) factors when issuing bonds, barred banks from considering “social credit” when making loan decisions and prohibited discrimination on the basis of political, social or religious ideology. Businessman Vivek Ramaswamy, former Ambassador to the United Nations Nikki Haley and former President Donald Trump have criticized DeSantis, a potential 2024 candidate for the Republican presidential nomination, over the feud with Disney that started after DeSantis signed parental rights legislation in March 2022 over the company’s opposition.

Read MoreCommentary: The Great Carbon Capture Scam

Carbon capture is like burning witches.

In the 15th to 17th centuries, the elite in Europe and the United States believed that “evil humans were negatively affecting the climate and weather patterns.” The people were demanding something — anything — be done about famine and crop failure. There must be consequences, facts be damned, so inconvenient women on the fringes of society were labeled “witches” and burned at the stake in droves.

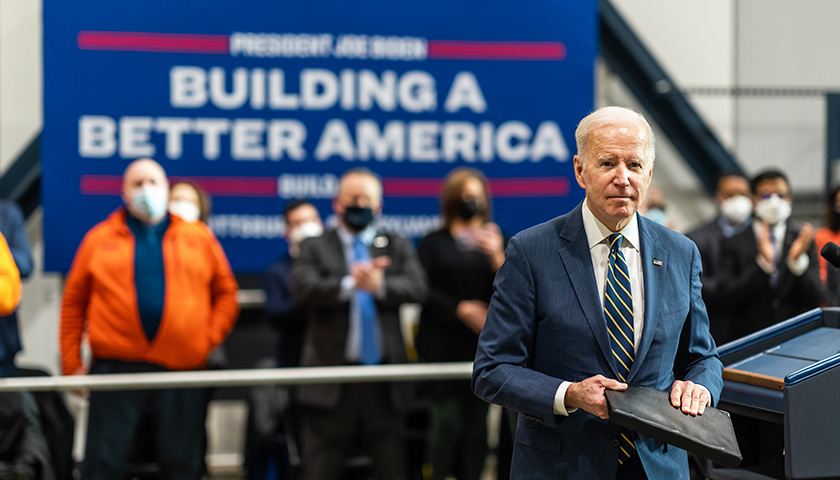

Read MoreBiden Issues First Veto of Presidency, Allowing Labor Deptartment to Use ESG Factors in Investments

President Biden on Monday issued the first veto of his presidency, blocking a measure passed last week by Congress to overturn a Labor Department rule allowing retirement plans to consider environmental, social and governance factors when making investment decisions.

The GOP-led effort received congressional passage last week in the Democrat-controlled Senate, with the White House saying it would likely get a presidential veto.

Read MoreRon DeSantis to Lead 18 States in Alliance Against Woke Investing

Florida Gov. Ron DeSantis is leading an 18-state alliance to combat “woke” environmental, social and governance (ESG) investment policies.

The alliance, formally announced Thursday, comes after President Joe Biden vowed to veto an anti-ESG bill that intended to roll back a Department of Labor rule allowing pension and retirement fund managers to weigh ESG factors when determining investments. The governors will lead “state-level” initiatives to protect “Americans’ financial freedom” by allocating state funds accordingly.

Read MoreCommentary: SVB, ESG, and Biden’s ERISA Rule

The collapse of Silicon Valley Bank (SVB) occurred just days after Congress passed the Braun-Barr resolution, which overturns the Biden administration’s “Prudence and Loyalty” rule and its encouragement of environmental, social, and governance (ESG) investing by pension managers under the Employee Retirement Income Security Act (ERISA). The timing could hardly be more instructive. The Prudence and Loyalty rule, the White House had recently argued in its defense, “reflects what successful marketplace investors already know – there is an extensive body of evidence that environmental, social, and governance factors can have material impacts on certain markets, industries, and companies.”

Read MoreBlackRock CEO Scales Back Emphasis on Climate Investing: Not the Environmental Police

CEO Larry Fink of investing titan BlackRock put reduced emphasis on climate and other environmental, social and governance (ESG) goals in an annual letter to the company’s investors and stakeholders Wednesday, amid Republican criticism of his firm’s investing strategy.

BlackRock has faced significant criticism from Republicans, who allege that the company has focused too much on “woke” investing to the detriment of its clients, and more recently Democrats who argue the company hasn’t gone far enough with its ESG efforts. Fink’s reduced emphasis on his firm’s role in the energy transition stands in stark contrast to his 2020 letter to investors, in which he argued the company had a “significant responsibility … to play a constructive role” in the transition to low-carbon sources of energy, Axios reported.

Read MoreCommentary: Corporations Embracing ESG Must Lose Their Legal Protection

ESG, an acronym for Environmental, Social, and Governance, is everywhere. If you work for, advise, invest in, regulate, study, or otherwise care about one or more corporations, you’ve likely encountered the term. Consultancies, banks, investment funds, managers, governments, and international organizations trip over themselves touting their ESG scores and credentials.

Read MoreRed States Use Purse Strings to Check Momentum of ESG Woke Investing Movement

With the woke investing movement known as Environmental Social and Governance gaining steam in corporate boardrooms and asset management firms across the U.S., red states are pushing back.

The ESG counteroffensive includes economic and legislative moves ranging from the leveraging of public investment to laws mandating that fiduciaries of public funds make investment choices based on financial rather than ideological criteria.

Read MorePrestigious Business Schools Train Students in Woke Capitalism

Prestigious business schools across the country are adding more opportunities to study diversity equity and inclusion (DEI) and environmental, social, and governance (ESG), a trend that’s expected to continue, professors told the Daily Caller News Foundation.

ESG prompts investors to consider factors such as environmental impact and social awareness when making investments, while DEI is a push to increase diversity and inclusion initiatives in institutions such as schools and the workplace. Harvard University, the University of Pennsylvania (UPenn), and Bentley University all offer courses in both subjects as they grow more prominent.

Read More’60 Minutes’ Airs Apocalyptic ‘Humanity Is Not Sustainable’ Segment to Ring in 2023

CBS’ “60 Minutes” opened 2023 by airing a segment about the dangers of population growth featuring biologist Paul Ehrlich, who has long predicted societal collapse and disaster due to high population.

Ehrlich, a Stanford University professor, said humanity was not sustainable and reiterated his concerns that the planet’s human population was crowding out the natural environment to our own peril. While the world population is still rising, the rate of human fertility plummeted by roughly 50% across the globe in the last 70 years; the average family had five children in 1952, but now has fewer than three.

Read MoreCommentary: ESG Cancel Culture Comes for State Financial Officers

As the leader of a nonprofit group whose mission is to promote economic freedom, sound public policy, and responsible financial management at the state level, I’m honored to help our nation’s financial officers practice good stewardship of taxpayer dollars. Their work often includes managing pension funds that are vital to millions of Americans’ retirement security. Over the past few years, a growing threat called ESG (Environmental, Social, Governance) has been negatively impacting state pension systems, ultimately putting retirees at risk. Sadly, our nation’s state financial officers and the retirees they have a fiduciary responsibility to protect are increasingly under siege by ESG ideologues who are motivated by politics rather than economics.

Read MoreCommentary: The Left’s Corporate ‘ESG’ Movement Is Coming After All Americans, but We Can Stop It

In a House Financial Services committee hearing last week, Rep. Rashida Tlaib asked CEOs of major banks whether they would go along with her ESG agenda and commit to stop funding fossil fuels.

Read MoreCommentary: ‘Environmental, Social, and Governance’ Policymaking Is the Left’s Latest Destructive Tactic to Bully Business

Reports about ESG — “environmental, social, and governance” scores that progressive activists, money-management firms, and government agencies (namely, the Securities and Exchange Commission) assign to corporations — have become nearly ubiquitous in the news. There is even a website, esgnews.com, that keeps track of the latest ESG-related developments.

Read More‘Socialism in Sheep’s Clothing’: Pro-Market Leaders Combat ESG, Liberal Capture of Corporate America

Pro-market elected officials and thought leaders are fighting back against progressive activists’ creeping capture of corporate America through the Environmental Social and Governance movement..

ESG investment strategies, increasingly prevalent among large asset management firms, seek to leverage passive investors’ assets to steer corporate decision-making to promote progressive social and environmental priorities. ESG has often been compared to the “social credit” system used by China’s ruling communist elite to enforce political conformity on its population.

Read MoreCommentary: BlackRock’s Stakeholder Capitalism for Thee, Not for Me

Blackrock has gone from being known as the largest asset manager in the world to being known as the investment company that pushes a social agenda on the companies it invests in. From cajoling corporate America into signing the manifesto of stakeholder capitalism, the Business Roundtable Statement on Corporate Responsibility, to putting anti-oil board members on the board of oil companies, Blackrock has developed a reputation, at least among conservatives, as a company that is imposing CEO Larry Fink’s social agenda on American capitalism.

In fact, the reputational issue is so prevalent that Fink spent much of the recent annual report rebutting it, arguing that what he is practicing is simply capitalism and that the imposition of climate change minimization measures and other ESG issues relevant to stakeholders is simply capitalism. The standard arguments here are that practicing ESG is not politics but rather risk management. Typically ESG proposals talk about reputational risk or the risk that at some point in the future governments will embrace the values expressed in ESG circles and impose them involuntarily on businesses. In such cases, for example, fossil fuel companies will be stuck with “stranded assets”, i.e. oil and gas wells rendered worthless by the coming age of enlightened energy regulation.

Read MoreCommentary: Net-Zero and ESG Are Worsening the Energy Crisis – and Weakening the West

The day after President Biden announced that the United States would ban imports of Russian oil and gas, a group of eleven powerful European investment funds that includes Amundi, Europe’s largest asset manager, outlined plans to force Credit Suisse, Switzerland’s second largest bank, to cut its lending to oil and gas companies. The juxtaposition of these two events dramatizes the fundamental disunity of the West. At the same time as the Biden administration is sanctioning Russian oil and gas producers, Western investors are sanctioning Western ones. Under the banner of ESG (environmental, social and governance) investing, the West’s capital is being deployed to create an artificial shortage of oil and gas produced by its companies and reward non-Western oil and gas producers such as Russia and Iran with higher prices. In doing so, the West is undermining its own security interests.

Before Russia’s invasion of Ukraine, energy markets were already extremely tight. In the past, high oil and gas prices stimulated a supply-side response leading to increased output and to prices falling back. This relationship has broken down. According to analysts at JP Morgan, capital spending by S&P Global 1200 energy companies peaked in 2015 at just over $400 billion and shrank to around $120 billion last year – less than half its previous trough of $250 billion in the aftermath of the 2008 financial crisis, even though global demand is now around 15% higher than it was then.

Read More