The Federal Reserve hiked its target federal-funds interest rate by a quarter of a percentage point Wednesday, the ninth in a series of hikes that started in March 2022.

Read MoreTag: inflation

Inflation Continues to Outpace Wages, Data Shows

Inflation has outpaced wages for nearly two years, recently released federal data shows.

A closer look at federal wage and pricing data shows workers are making less overall as the price for all kinds of goods and services rise faster than average hourly wages.

The U.S. Bureau of Labor Statistics tracks “real” average hourly earnings, which are wages of Americans with rising inflation taken into account.

Read MorePoll: Inflation Has Americans Worried About Covering Expenses After Job Loss

A majority of Americans polled said they couldn’t afford to pay emergency expenses or cover their living expenses for just one month if they lost their primary source of income, according to Bankrate’s latest Annual Emergency Savings Report. The main reason cited is record-high inflation.

The majority surveyed, 68%, said they’re “worried they wouldn’t be able to cover their living expenses for just one month if they lost their primary source of income.”

Read MoreFed’s Favorite Inflation Index Blew Past Expectations in January

The Federal Reserve’s preferred measure of inflation, the personal consumption expenditures (PCE) price index, surged past economists’ expectations in January, breaking a recent downward trend, according to the Bureau of Economic Analysis (BEA) Friday.

The PCE price index jumped by 0.6% on a monthly basis, and climbed to 5.4% on a year-over-year basis, up from 5.3% in December, the BEA reported. Economists had predicted the year-over-year number would continue to fall to 5% in January, but prices instead shot up at the highest levels since June, The New York Times reported.

Read MoreInflation Continues to Worry Georgians, Groups Say

Inflation will likely stick around for the foreseeable future, and the elevated inflation continues to worry Georgia businesses, groups said.

The U.S. Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers increased by 6.4% over the past 12 months, higher than anticipated. Additionally, the Producer Price Index increased by 6% over the same period.

Read MoreCommentary: ‘Economist’ Krugman’s Accounting of the National Debt is Jailworthy

The national debt has risen at a blistering pace over recent decades and is now higher than any era of the nation’s history—even when adjusted for inflation, population growth, and economic growth (GDP).

Denying this reality, Nobel Prize-winning economist Paul Krugman recently wrote two columns for the New York Times in which he claimed that the debt is an “overhyped issue” and “isn’t all that unusual” from a historical perspective. His attempts to support these assertions employ the kind of fraudulent accounting that could land a corporate executive in jail.

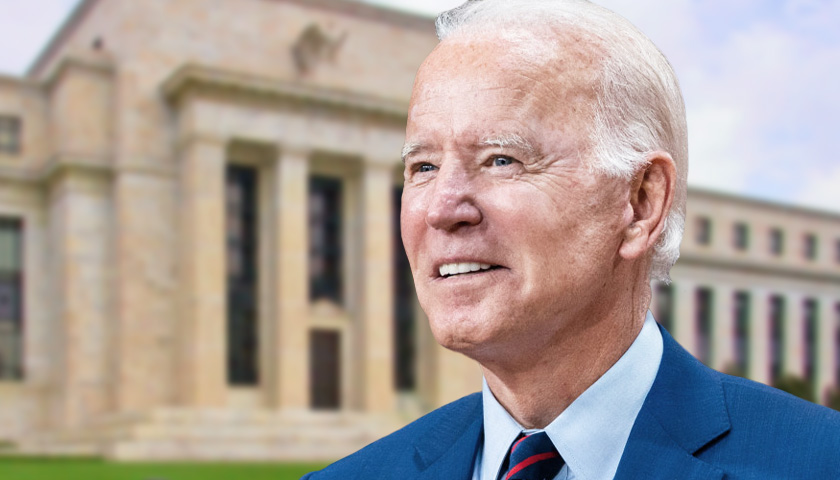

Read MoreCommentary: Biden Has Mastered the Art of Dodging Blame for Inflation

It is frustrating that so many otherwise competent, knowledgeable economists and commentators are failing to land a punch on President Joe Biden regarding inflation.

It’s not that people don’t know the economy is floundering. They do. Almost 66% of Americans believe the country is on the wrong track, according to the latest RealClearPolitics polling average, a sentiment driven by inflation and the difficulties it has caused for people trying to keep up with household expenses.

Read MoreInflation Rebounds in January

The U.S. Bureau of Labor Statistics released fresh inflation figure Tuesday which show inflation picked back up in January.

The BLS Consumer Price Index rose 0.5% last month, part of a 6.4% increase over the last year. Overall, January’s rate is not as high as the peak inflation spikes seen in recent years, but it is still well above the increases considered advantageous by most economists.

Read MoreFed Hikes Interest Rates to Highest Levels in 15 Years

by John Hugh DeMastri The Federal Reserve raised its target federal-funds interest rate by a quarter percentage point Wednesday, the slowest in a series of eight hikes that began in March 2022. The hike brings the Fed’s target rate to a range between 4.5 percent and 4.75 percent, with…

Read MoreFed Likely to Raise Interest Rates, But at a Less Aggressive Rate

The Federal Reserve is likely to further slow its historically aggressive pace of interest rate hikes at its Wednesday meeting as inflation cools, but consumers will still feel the pinch of higher interest rates, according to economists who spoke with the Daily Caller News Foundation. The Fed is likely to hike interest rate hikes by just 0.25 percentage points after its Wednesday meeting, setting the range for its target federal-funds rate to between 4.5% and 4.75%, due to slowing inflation, The Wall Street Journal reported.

Read MoreInvestigation Launched Into 3-Alarm Blaze That Killed 100,000 Chickens at Hillandale Connecticut Egg Farm

An investigation has been launched into a three-alarm fire Saturday that reportedly killed about 100,000 chickens at the Hillandale egg farm in Bozrah, Connecticut. At least 16 firehouses and more than 100 firefighters responded to the massive blaze, reported Fox61 News.

Read MoreBorder Police Dealing with New Smuggling Problem: Eggs

The United States Customs and Border Protection is asking Americans to stop trying to smuggle in raw eggs from Mexico.

Read MoreCommentary: The Unknown Impact of Inflation on Rural Americans

When the Federal Reserve convenes at the end of January 2023 to set interest rates, it will be guided by one key bit of data: the U.S. inflation rate. The problem is, that stat ignores a sizable chunk of the country – rural America. Currently sitting at 6.5%, the rate of inflation is still high, even though it has fallen back slightly from the end of 2022.

Read MoreElectricity Prices Jumped More than Double that of Inflation Last Year, Consumer Index Shows

Prices for electricity in the United States soared well above overall inflationary levels last year, putting an added squeeze on consumers already reeling from significantly inflated costs of most consumer goods. The Consumer Price Index Summary released by the U.S. Bureau of Labor Statistics this month showed the 12-month average price of electricity last month jumping a whopping 14.3 percent, more than double the 6.5 percent of overall price increases.

Read MoreKemp Budget Proposal Includes More Tax Rebates, Spending on Schools and Police, and a 2024 Cost of Living Increase for State Employees

Governor Brian Kemp announced his budget proposal on Friday, highlighting $250 income tax rebates, one-time discounts on homeowner property tax, and spending on education, economic development, improving healthcare access, and a $2,000 cost-of-living increase for state employees.

“Despite national economic headwinds caused by 40-year high inflation, Georgia’s economy remains a leader nationwide. As we look ahead to the upcoming fiscal year, we expect the state’s economy to be well positioned to withstand any further national economic slowing,” he said in a letter to lawmakers.

Read MoreCommentary: Wokeness Is Hollowing Out The Fed

Are you wondering why checking out at the grocery store these days feels like making a mortgage payment? This week’s four-decade-high inflation is a direct result of the Federal Reserve taking its eye off the ball over the last two years. Instead of focusing on its mandate of keeping prices stable, it has been more concerned with financing massive federal deficits and kowtowing to liberal ideology.

But now the Fed chair is claiming just the opposite.

Read MoreNonprofit Says Georgians Are Still Hurting from Inflation

While the Consumer Price Index for All Urban Consumers dropped 0.1% in December and the year-over-year inflation rate stands at 6.5%, a Georgia nonprofit says Peach State residents may not be feeling the good news.

“We keep seeing positive headlines about the inflation rate, but that good news is lost on average Georgians who are continually pinched on the cost for everyday necessities like groceries and gas,” Erik Randolph, Georgia Center for Opportunity’s director of research, said in a statement. “Although there was some positive news in the December numbers, it’s important to keep in mind that core inflation remained elevated, including for food. If policymakers in Washington truly want to help the most economically vulnerable in our country, they must return to fiscal sanity and rein in the spending.

Read MoreAt Inauguration, Georgia Gov. Kemp, LG Jones Call for Tax Relief, Money for Law Enforcement and Schools, and Tougher Sentencing Guidelines

During their inaugural speeches, Governor Brian Kemp and newly-elected Lieutenant Governor Burt Jones painted a picture of Republican successes in Georgia but called for further tax relief, investment in schools and health care, and tough-on-crime policies. “Last year on the campaign trail, no matter where we went, hard-working Georgians told…

Read MoreConsumers Are Paying Record Credit Card Rates Due to Inflation

Average interest rates for bank-issued credit cards this past November surpassed a record set in 1985, Axios reported Wednesday, citing data from the Federal Reserve.

The previous record rate was 18.9%, set in the first quarter of 1985, with November’s rate of 19.1% comfortably eclipsing it, according to Axios. Credit card interest rates climbed alongside the Federal Reserve’s federal funds rate, which the Fed hiked a historically aggressive pace in 2022 to blunt economic demand and reduce the impact of inflation, NPR reported.

Read MoreGeorgia Gas Tax Moratorium Ends, Rises to 31.2 Cents

Governor Brian Kemp allowed Georgia’s moratorium on state gas and diesel taxes to expire on Tuesday night, after first introducing the moratorium in May and renewing it six times since then.

In 2022, Georgia’s gas tax was 29.1 cents and the diesel tax at 32.6 cents, but that’s going up on Wednesday to 31.2 cents and 35 cents, respectively. As of January 10, before the taxes took effect, Georgia’s average gas price was $2.808, below the national average of $3.270, according to AAA Gas Prices.

Read MoreBig Banks Predict Significant Economic Downturn in 2023: POLL

Of the 23 major financial institutions that work directly with the Federal Reserve, 16 anticipate a recession within the next 12 months, with two anticipating one the year after, according to a survey published by The Wall Street Journal Monday.

These institutions, which range from Bank of America to UBS, note that Americans are spending their savings, banks are heightening lending standards and the housing market is in a decline, all classic warning signs that a recession is impending, the WSJ reported. All of this is being exacerbated, the banks say, by the Fed’s historically aggressive pace of interest rate hikes, designed to blunt stubbornly persistent inflation.

Read MoreAmid Soaring Food Prices, Americans Hope for Relief

Food prices soared in 2022, and so far there are few solutions on the horizon for 2023.

The latest Consumer Price Index Data from the Bureau of Labor Statistics found that grocery prices increased 12% in the previous 12 months, far higher than the already elevated inflation rate.

Read MoreVenezuela, Cuba, and Argentina Have the Highest Inflation in Latin America

Venezuela, Cuba and Argentina registered the highest inflation in 2022 compared to other Latin American countries, according to figures from the Economic Commission for Latin America and the Caribbean (ECLAC) and BCC reports .

The report covers the period between October 2021 and October 2022, where the highest growth of the index is led by the Caribbean country, which accumulates an increase in inflation of 146%, exceeding that of Argentina by more than 50 percentage points (87 8%), the second on the list, and Cuba, which ranked third with 34.2%.

Read MoreInflation Rose Slightly in November, Data Shows

Newly released federal inflation data shows that inflation rose slightly in November.

The Bureau of Economic Analysis released its Personal Consumption Expenditure Index Friday, a key inflation marker, which showed a 0.1% increase in November, contributing to a 5.5% increase from the same time last year.

Read MoreCommentary: Inflation Takes a Bite Out of Christmas Cheer

Americans may want to light the fireplace more often this winter and cut back on the holiday festivities, according to new data from the Energy Information Administration and the Bureau of Labor Statistics.

Energy costs have remained consistently high for over a year, having risen over 13% since November 2021. So, American families can expect to pay significantly more for their heating oil as the colder months approach. As of the week of Dec. 12, the average cost for residential heating oil hit $4.56 per gallon, which is about 95% higher than it was the week of Dec. 14, 2020, shortly before President Joe Biden took office.

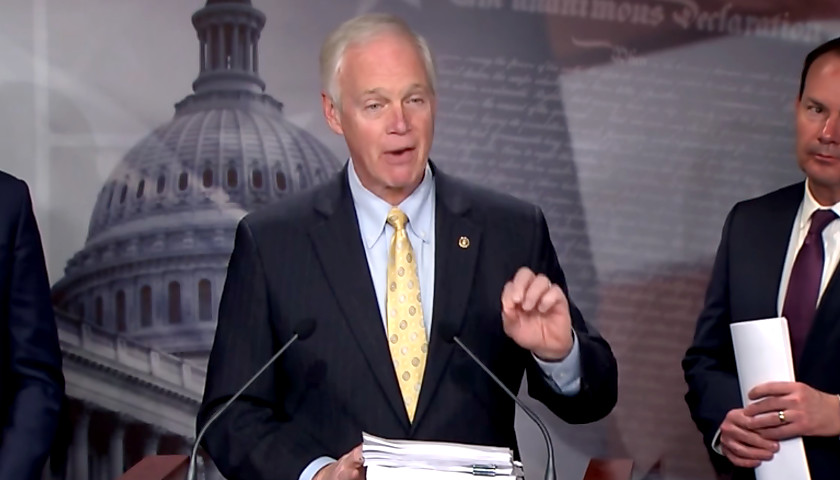

Read MoreSen. Ron Johnson Argues to Eliminate $9.8 Billion in Earmarks From $1.7 Trillion Omnibus Bill

Wisconsin Senator Ron Johnson (R) joined with his colleagues Senators Rick Scott (R-FL), Mike Lee (R-UT), Mike Braun (R-IN), and Rand Paul (R-KY) to oppose the $1.7 trillion omnibus spending bill and argue for an amendment that would eliminate all earmarks.

“Thousands of individual projects here, both Democrat and Republican,” Johnson said Tuesday during a press conference

Read MoreSmall Businesses Report Hardship Due to Inflation This Christmas Season

Small businesses around the country still see inflation as a top concern this Christmas season.

Goldman Sachs released survey data that found that 52% of surveyed small business owners say that their profitability “has not met expectations. Even while an overwhelming 79% have increased prices compared to last year.”

Read MoreFederal Reserve Raises Rates by Half Percentage Point, Signaling Slowing of Rate Hikes

The Federal Reserve on Wednesday announced a reduced but still notable hike in U.S. interest rates, with the central bank moving to hike rates by half a percentage point as part of its ongoing efforts to tamp down inflation.

The hike, which comprises 50 basis points, is less than the three-quarter-point hikes the bank has enacted every month for the last several months, though it still represents a significant raise at a time when the economy remains fragile after years of turmoil and unertainty.

Read MoreFederal Inflation Data: Grocery Prices Continue to Rise Nationally

While overall inflation has slowed from its rapid pace earlier this year, grocery prices continue to rise, putting Americans in a pinch, according to newly released federal inflation data.

The U.S. Bureau of Labor Statistics released the monthly Consumer Price Index report, which showed prices rose 0.1% in November, less than experts predicted, contributing to a 7.1% increase in the past 12 months.

Read MoreAverage American Family Has Effectively Lost $7,100 Under Biden, Economist Says

An economist says the average American family has effectively lost more than $7,000 due to inflation and higher interest rates since President Joe Biden took office.

The consumer price index, a key inflation measure, increased 0.1% in November, up 7.1% from November 2021, the U.S. Bureau of Labor Statistics reported Tuesday. The figure marks a slowdown in rampant inflation, but not a reversal of the trend that has caused prices for everyday goods like food and gas to ratchet up in recent months.

Read MoreWhite House to Go on Offensive Against GOP as Gas Prices Drop

The average price for a gallon of gas has fallen below what it was one year ago, and the White House is preparing to go on the offense politically as consumers see more money in their pockets ahead of the holidays. The administration argument? Thank President Biden.

Read MoreCommentary: Biden Admin Blames the American People for its Own Ludicrous Spending

Last week, Treasury Secretary Janet Yellen blamed the American people for the 40-year high inflation we have been enduring.

Appearing on “The Late Show with Stephen Colbert,” she said that Americans “were in their homes for a year or more, they wanted to buy grills and office furniture, they were working from home, they suddenly started splurging on goods, buying technology.” According to her, this consumer “splurging” caused prices to rise so much.

Read MoreKey Inflation Metric Shows High Prices Aren’t Going Anywhere

Wholesale prices beat expectations in November, a sign that inflation might not fall as quickly or steeply as previously hoped, according to CNBC.

Producers and businesses saw prices rise 0.3% from October, with so-called “core prices” rising 0.4% when the more volatile food and energy sectors were discounted, according to the Bureau of Labor Statistics (BLS). With both measures expected to rise by just 0.2%, as well as a 3.3% increase in food costs offsetting a 3.3% decline in energy costs, producers prices are still set to remain well above pre-pandemic levels, even though they have fallen from the 11.7% year-over-year surge seen in March, CNBC reported.

Read MoreInflation Slows, but Americans Still Feel It

Inflation has slowed from its rapid growth in the past two years, but surveys show Americans are still feeling the pain from the jump in prices.

Gallup released new polling data Tuesday showing that 55% of those surveyed say inflation is causing financial hardship for their household. Notably, 13% of Americans say inflation has caused their families “severe hardship.”

Read MoreCommentary: Don’t Give an Inch on the Debt Ceiling

The dust has barely settled from the contentious midterms, and the battle lines are already being drawn for the next legislative fight in Washington: the debt ceiling. With the nation at unprecedented levels of indebtedness, the choice in this fight is a stark one: a path toward stability or fiscal Armageddon.

If that sounds hyperbolic, consider the following facts about America’s finances.

Read MoreInflation Rose Slightly in October

Inflation rose slightly in October, newly released federal data show.

The Bureau of Economic Analysis released the Personal Consumption Expenditure index, a key inflation marker, which showed the index rose 0.3% in October.

Read MoreCommentary: A Blueprint for Tackling America’s Crippling National Debt

Our debt is too large. Inflation is too high. We rarely pass a budget anymore — this year neither Budget Committee even bothered to come up with one. This is how great nations become weakened nations, and with all the threats on the world stage, it is urgent we make a change now.

What we need is a budget that changes our fiscal trajectory away from one where the debt is growing faster than the economy, to one where it is stabilized and then gradually brought down.

Read MoreCommentary: Don’t Be Fooled by October’s Decrease in the Rate of Inflation

October’s Consumer Price Index, the measure of the national rate of inflation, was at 7.7 percent in October, compared to a reading of 8.2 percent in September. The report propelled “U.S. stocks forward [at the open] and sent Treasury yields tumbling as Wall Street weighed the implication of softer prints on Federal Reserve policy.”

The decline in the rate of inflation was driven by declining annual prices of “necessities” such as smartphones (-22.9 percent), admission to sporting events (-17.7 percent), televisions (-16.5 percent), and women’s outerwear (-1.4 percent), all items that are discretionary purchases.

Read MoreFarm Bureau Survey Finds Thanksgiving to Be the Most Expensive Yet as Cost Rises 20 Percent

Thanksgiving dinner will cost 20% more this year compared to last year, according to a Farm Bureau survey published Wednesday, with the market signaling record-high prices for the second year in a row.

The average cost to feed 10 people for Thanksgiving will be $64.05, or under $6.50 per person, the Farm Bureau said. This is a $10.74 or 20% cost increase from 2021’s average of $53.31, which was also a record high at the time, according to historical data.

Read MoreInflation Has Cost Average Americans Thousands of Dollars, Economist Says

An economist says the average American family has lost upward of $7,000 due to inflation.

The consumer price index increased 0.4% in October, up 7.7% from Oct. 2021, the U.S. Bureau of Labor Statistics reported on Thursday.

Read MoreCommentary: Even Corporate Media Is Calling Out Biden’s Absurd Economic Fairytales

With only days left until the midterm elections, the advertising blitz from the political spin doctors has reached a fever pitch and the sound bites we’re hearing aren’t very sound, especially the ones from the White House on the economy. But heated rhetoric is hardly a replacement for facts and figures so, to borrow a phrase from the show Dragnet, let’s discuss “just the facts, ma’am.”

Read MoreGeorgia Department of Transportation Awarded $91.4 Million in Projects for September

The Georgia Department of Transportation awarded more than $91.4 million for 22 projects in September, officials said.

Nearly half (47.8%) went to bridge projects, while about a third (31.8%) went to resurfacing projects. An additional 19.2% went to safety projects, while 1.1% went to widening and reconstruction projects.

Read MoreThe Federal Reserve Hikes Rates Again as Inflation Rages on

The Federal Reserve announced an interest rate hike of 0.75 percentage points, bumping the range of the federal interest rate to between 3.75% and 4% following a Wednesday meeting of Fed policymakers.

Read MoreInflation, Supply Chain Woes Raise Costs for Georgia Road Projects

Inflation is driving up the cost of road projects in Georgia, with some project bids more than 40% higher than projected.

As a result, Georgia Department of Transportation officials have rejected some high bids and deferred resurfacing projects for the last six months.

Read MoreNew Poll Smothers Democrats’ Hopes That Abortion Can Thwart a Red Wave

Abortion is not a top priority for female voters and most women support abortion limits that would have been considered unconstitutional under the Roe v. Wade precedent, a new poll found, dashing Democrats’ hopes of an electoral advantage over abortion.

Inflation was about four times as likely to be listed as the most important issue for female respondents compared to abortion, with only 54% saying abortion was very important in determining their vote compared to 74% for inflation, according to the RMC Research/America First Policy Institute poll shared exclusively with the Daily Caller News Foundation. The polling cuts against a common Democratic talking point: that overturning Roe would be an electoral boon for Democrats as pro-abortion voters, and women in particular, flocked to the polls in November.

Read MoreGeorgia Democrat Stacey Abrams on Why Abortion Is Necessary: ‘Having Children Is Why’ You’re Worried About Food and Gas Prices

Georgia Democrat gubernatorial hopeful Stacey Abrams said Tuesday access to abortion is necessary because “having children is why you’re worried about your price for gas … how much food cost.”

“You can’t divorce being forced to carry an unwanted pregnancy from the economic realities of having a child,” she told MSNBC’s Morning Joe.

Read MoreIRS Makes Highest Deductible Hike on Record Due to Inflation

The Internal Revenue Service (IRS) increased the individual tax deductible for 2023 at the highest rate in more than 35 years due to inflation.

Individual tax deductibles increased by $900 to $13,850, up $1,800 to $27,700 for married couples filing jointly, a roughly 7% increase compared to tax year 2022, the IRS announced Tuesday. This increase is the largest hike since 1985, when tax brackets were first tied to inflation, The Washington Post reported.

Read MoreAbrams Suggests Abortion Is ‘Economic Imperative,’ Particularly Now amid High Inflation

Stacey Abrams on Wednesday implied that abortion can and is used by women to help keep costs down amid rising inflation.

During an interview on MSNBC with “Morning Joe’s” host Mike Barnicle remarked that abortion “nowhere reaches the level of interest to voters” as does sky-high inflation prices for groceries, gas and other consumer products.

Read MoreAmericans Cut Back on Groceries Because of Inflation

Newly released polling data shows that inflation is causing most Americans to cut back at the grocery store.

Morning Consult released the survey results, which showed that 82% of American shoppers report trying to save on groceries in the last month because of inflation with more and more Americans simply buying less at the store.

Read MoreReal Retail Spending Fell in September as Inflation Pinches Consumers

Retail spending held steady in September compared to August, but fell adjusted to inflation as consumers spent more on essentials, The Wall Street Journal reported Friday.

Despite the fact that consumers spent roughly the same as they did in August, $684 billion, according to the U.S. Census Bureau, these results are not adjusted for inflation, which rose 0.4% on a monthly basis in September, indicating that consumers were getting less value from their spending, according to CNBC. For example, spending at bars and restaurants grew by 0.5% in September, but prices at the same establishments increased by 0.9%, the WSJ reported.

Read More