The Republican majority in the United States House of Representatives is now planning to vote on a stopgap spending bill that will not include a critical election integrity measure that conservatives have been desperately trying to pass.

Read MoreTag: spending

Biden’s White House Spending Dwarfs Trump, Obama

President Joe Biden’s White House staff has grown to historic highs, costing taxpayers tens of millions of dollars, according to a new report.

An analysis from OpenTheBooks of the recently released White House payroll found the Biden White House staff spending has hit new highs.

Read MoreGeorgia Lawmakers Approve Budget as Session Ends

Georgia lawmakers signed off on the fiscal year 2025 budget in the final hours of this year’s legislative session but did not pass a bill to allow sports betting.

Lawmakers gave the nod to a more than $66.8 billion state budget for fiscal 2025, which starts July 1. The spending plan, which anticipates $36.1 billion in state money and $19 billion in federal taxpayer funds, includes pay raises for public school teachers and state law enforcement officers.

Read MoreCommentary: Unemployment Up Another 760,000 Since December 2022 as Unemployment Rate Jumps to 3.9 Percent

Don’t look now, but U.S. labor markets appear to be churning in the wrong direction, as the unemployment rate jumped to 3.9 percent in February, and the unemployment level hit a new high for this cycle at almost 6.5 million, up 760,000 from its low this cycle of 5.7 million in Dec. 2022, according to the latest data from the Bureau of Labor Statistics.

Read MoreAnalysis Ties Surge in Inflation to Increased Spending, Value of Debt

The U.S. government and those of other countries could be using higher inflation to lessen the value of growing public debt resulting from increased spending during the COVID-19 pandemic, according to a new analysis by a Harvard economist working with The Heritage Foundation.

The study covers government spending from 2020 through 2022, the high point of the pandemic, and looked at the U.S. and 20 other economies in the Organization for Economic Cooperation and Development, or OECD.

Read MoreFederal Debt Up $6.2 Trillion Under Biden – $47,462 per Household

The federal debt increased by $6,238,231,285,652.06 between Jan. 20, 2021, the day President Joe Biden was inaugurated, and Jan. 2, 2023, the last day for which the debt has been reported.

That equals $47,462.84 for each of the 131,434,000 households that the Census Bureau estimates were in the United States in 2023.

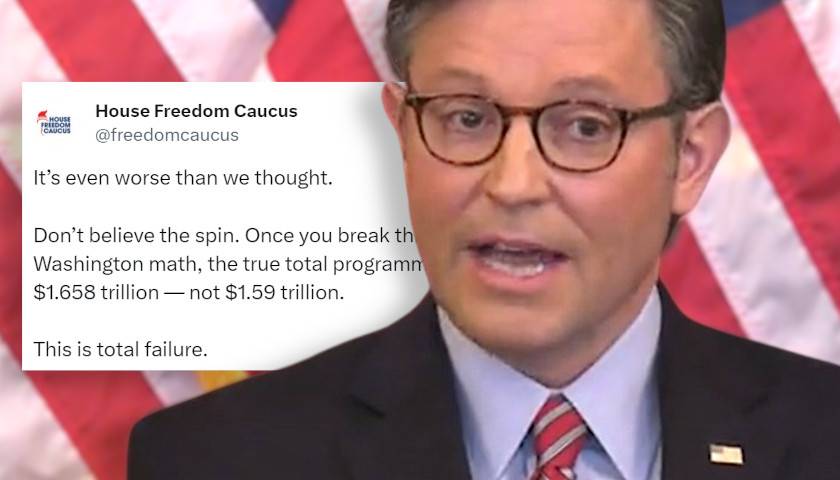

Read MoreHouse Freedom Caucus Calls Speaker Johnson’s Proposed Spending Deal with Schumer ‘Total Failure’

The conservative House Freedom Caucus slammed House Speaker Mike Johnson’s proposed top-line spending deal with Senate Democrats as a “total failure,” arguing the potential agreement costs about $68 billion more than the Louisiana Republican said it would.

Read MoreSpeaker Johnson Announces Spending Deal to Avert Shutdown

House Speaker Mike Johnson on Sunday said Congressional leaders reached a topline spending deal to avert a federal government shutdown by providing funding through the rest of the fiscal year.

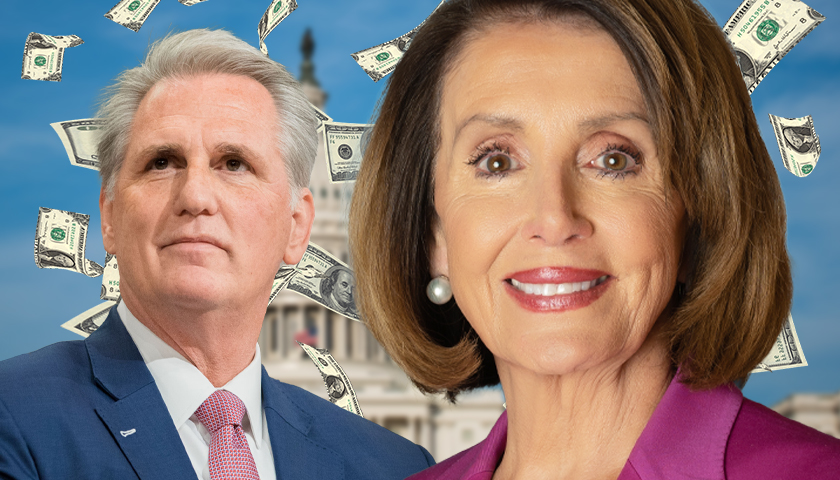

Read MoreMeet the Leaders in Congress Who Helped Amass a Staggering $34 Trillion in National Debt

The national debt continues to rise sharply to record levels during the ongoing debate in Congress over the next federal spending bill.

The federal government has already piled another $383 billion onto the debt so far into the 2024 fiscal year, which began on October 1.

Read MoreReport: Economic Recession Coming for the U.S.

A new economic analysis of the U.S. economy projects a recession around the corner.

An international nonprofit, The Conference Board, has released its Leading Economic Indicators report, which projects into the next year for the U.S. economy. That analysis, among other things, projects high inflation, high interest rates and declining consumer spending.

Read MoreCommentary: Oh Great, Another ‘Debt Commission’

Recognizing the precarious plight of the nation’s fiscal situation, newly installed House Speaker Mike Johnson has called for a bi-partisan commission to study the nation’s debt. Everyone involved in federal fiscal policy for a length of time surely responded with some variation on, “Good grief, Charlie Brown.” Congress has formed and ignored innumerable such groups over many decades.

Read MoreGaetz to Seek McCarthy Ouster after Shutdown Drama

Florida Rep. Matt Gaetz declared Sunday he will seek to oust Kevin McCarthy as House speaker after a drama-filled scramble to pass a federal budget forced a last-minute temporary spending bill that required Democrat votes to pass.

Read MoreCommentary: The New Right Cares About More than Taxes

New research is challenging assumptions about the Republican Party’s core values, showing the GOP of the 2020s is an entirely different animal from the GOP of the 2010s. The research captures an increasing shift toward populism and America First priorities that has been growing since Former President Trump’s election in 2016.

The study by American Compass divides Republicans into two camps, the Old Right and the New Right, based on their economic priorities and approach to cultural issues.

Read MoreGeorgia’s Tourism Industry Broke Records Last Year with Out-of-State Travelers Spending over $39.8 Billion

Tourism in the Peach State broke records last year, according to new data by the Georgia Department of Economic Development (GDEcD).

Read MoreCommentary: House Freedom Caucus Wants To Do Something About Out of Control Spending

On Monday, the House Freedom Caucus (HFC) struck a blow in the fight for fiscal displume. In a 431-word statement, the conservative House Republicans put Official Washington on notice that when Congress returned in September and took up the seemingly annual short-term spending bill known as a “Continuing Resolution,” the HFC would not vote to fund business as usual. Instead, HFC members would only support a short-term spending bill to keep the government open if it also included several of their key policy priorities – policy priorities that would represent significant shifts in key areas of government policy.

Read MoreHouse Conservatives Say Any Spending Bill Must Address Border Security, DOJ Weaponization

The House Freedom Caucus, a group of conservative lawmakers in the House, outlined Monday what conditions would need to be met for them to vote for a new spending bill.

The group is calling for spending bills to include provisions on border security, the “unprecedented weaponization” of the Justice Department and FBI, and the Pentagon’s “cancerous woke polices.” The lawmakers also oppose “any blank check for Ukraine in any supplemental appropriations bill.”

Read MoreCommentary: Could the Baby Boomer Retirement Wave and Labor Shortages Absorb the Recession?

The national unemployment rate dipped to 3.5 percent in July, according to the latest data from the Bureau of Labor Statistics, once again hitting more than 50-year lows.

It’s still peak employment as far as the eye can see. Even with the past two years’ high inflation dropping dramatically and disinflation usually correlating with higher unemployment and a recession, that simply has not occurred yet, despite all the warning signs typically associated with an economic slowdown or downturn.

Read MoreCommentary: The Educational Establishment’s Radical New Ploys

Increased spending, common good bargaining, community schools and transitional kindergarten will not improve student learning.

A Gallup poll released earlier this month shows that just 28% of Americans have “a great deal” or “quite a lot” of confidence in K-12 public schools. The number for Republicans is particularly damning: Just 14% of GOPers view education in a positive light.

Read MoreGeorgia Again Reports Decreased Tax Collections in June

Georgia reported decreased monthly tax collections for the fourth consecutive month.

Georgia’s net tax collections of more than $2.8 billion in June decreased 0.4 percent, or $10.9 million, compared to a year ago. The Peach State reported decreased tax collections in March, April and May.

Read MoreSenate Passes Compromise Debt Deal to Avert Default

The U.S. Senate on Thursday evening passed a compromise deal to suspend the debt ceiling until after the presidential election while capping the rate of spending growth in subsequent years.

Read MoreHouse Passes Compromise Deal to Suspend Debt Ceiling, Cut Spending

The House of Representatives on Wednesday evening passed a bipartisan deal to suspend the debt ceiling and cut spending ahead of a June 5 deadline to avert a national default.

Read MoreDeSantis Blasts McCarthy Over Budget Deal for ‘Careening Towards Bankruptcy’

by Harold Hutchison Republican Gov. Ron DeSantis of Florida ripped House Speaker Kevin McCarthy early Monday over the debt ceiling deal, calling it “totally inadequate” when it came to addressing spending. “Prior to this deal, Kayleigh, our country was careening toward bankruptcy and after this deal, our country will…

Read MoreGOP-Led House Expected to Vote Wednesday on Debt Limit Compromise Legislation

The GOP-led House is expected to vote Wednesday on the legislation resulting from a compromise between House Speaker Kevin McCarthy and President Joe Biden on the debt limit.

Read MoreCommentary: Any Debt ‘Default’ Will Be Biden’s Choice

There’s enough revenue to pay interest on the debt even if the $31.4 trillion debt ceiling is reached.

Meaning, if the U.S. defaults on the debt on June 1, it will be because President Joe Biden chose not to make principal and interest payments on U.S. Treasuries out of existing revenue, for which there is more than ample revenues to service and refinance up to the current debt ceiling limit, $31.4 trillion.

Read MoreCommentary: The ‘Limit, Save, Grow’ Plan’s Discretionary Spending Caps that Save More than $3 Trillion Might Not Be Enough

House Speaker Kevin McCarthy (R-Calif.) and the House Republican majority have unveiled their spending plan for the next decade, the Limit, Save, Grow Act, that will be tied to a $1.5 trillion increase in the $31.4 trillion national debt ceiling, the centerpiece of which imposes discretionary budget caps beginning in 2024, but which will be set at 2022 levels, which could save more than $3.2 trillion over the next decade, according to an estimate by the Committee for a Responsible Federal Budget.

While an official score still has not come in from the Congressional Budget Office, the proposal stands out as a promise kept on McCarthy’s part to use the must-pass debt ceiling to restore some semblance of fiscal sanity to the out-of-control federal budget and national debt, the latter of which the White House Office of Management and Budget projects will rise to a gargantuan $50.7 trillion by 2033.

Read MoreCommentary: The Interest Alone on the National Debt Will Hit $1 Trillion in 2024 as Reserve Currency Status Is Questioned

Gross interest owed on the $31.4 trillion national debt — that is, interest owed on both the $24.9 trillion publicly traded debt and the $6.7 trillion debt in the Social Security, Medicare and other trust funds — will reach a gargantuan $1 trillion in 2024 for the first time in American history, according to the latest data gathered by the White House Office of Management and budget.

To put that into perspective, that is more than is spent on national defense related spending, currently $814 billion.

Read MoreCommentary: Despite ‘Strong’ Rhetoric, Biden Administration Signals Gloomy Economic Outlook

The White House Office of Management and Budget (OMB) in the now-released President’s Budget is projecting just 0.6 percent in inflation-adjusted real growth of the U.S. economy in 2023 as the unemployment rate is expected to rise to 4.3 percent in 2023 and peak at 4.6 percent in 2024 after the economy is finished overheating from the continued, elevated inflation, consumers max out on credit and spending falls off a cliff.

Read MoreU.S. Projected to Tack on $19 Trillion in Debt over Next Decade as Spending Soars

The U.S. is likely to add $19 trillion more to the national debt in the next 10 years, which is $3 trillion higher than previously expected, new Congressional Budget Office (CBO) predictions show.

By the end of 2023, the CBO projects the deficit to be $1.4 trillion, and it will continue to average about $2 trillion annually, raising the debt to about $52 trillion. The CBO report indicates that the rise in the deficit is a result of bipartisan legislation coupled with the Federal Reserve’s hike in interest rates.

Read MoreGOP Lawmaker Floats Mechanism to Default Spending to Current Levels to Avert Debt Ceiling Crises

With the nation stuck at its $31.38 trillion debt limit and the Department of the Treasury imposing “extraordinary measures” to keep the government running, one GOP lawmaker is floating a new proposal to default federal spending to current levels to avert recurring standoffs over raising the debt ceiling.

Read MoreCommentary: Wokeness Is Hollowing Out The Fed

Are you wondering why checking out at the grocery store these days feels like making a mortgage payment? This week’s four-decade-high inflation is a direct result of the Federal Reserve taking its eye off the ball over the last two years. Instead of focusing on its mandate of keeping prices stable, it has been more concerned with financing massive federal deficits and kowtowing to liberal ideology.

But now the Fed chair is claiming just the opposite.

Read MoreHouse Speaker Fight Foreshadows Larger Debt Ceiling Battle on the Horizon for Republicans

The gridlock that paralyzed House Republicans over the past week in their quest to elect a new Speaker could be a foretaste of more to come, with party moderates and conservatives set to tangle in the months to come over raising the debt ceiling and reining in reckless government spending.

Although newly elected Speaker of the House Kevin McCarthy ultimately prevailed in his bid for the office over a small but determined band of House Freedom Caucus members, his slim GOP majority in the House will be vulnerable if and when conservatives rebel again down the road, as some are predicting, in an effort to reassert debt reduction as a top priority for the party.

Read MoreCommentary: The $1.7 Trillion Omnibus Prioritizes Diversity, Equity, and Inclusion in Higher Education and STEM Spending

The national debt is growing, but Congress’ recent spending bill is a telltale sign that it has no intention of shrinking the deficit.

After receiving bipartisan support in the Senate, the House passed a 1.7 trillion spending bill on Dec 16, avoiding a government shutdown.

The bill allocates funding mostly to defense, including $45 billion to Ukraine, which will assist the country in its war effort against Russia.

Read MoreCommentary: Biden Admin Blames the American People for its Own Ludicrous Spending

Last week, Treasury Secretary Janet Yellen blamed the American people for the 40-year high inflation we have been enduring.

Appearing on “The Late Show with Stephen Colbert,” she said that Americans “were in their homes for a year or more, they wanted to buy grills and office furniture, they were working from home, they suddenly started splurging on goods, buying technology.” According to her, this consumer “splurging” caused prices to rise so much.

Read MoreCommentary: It’s the Most Wonderful Time of the Year (for the Washington, D.C. Establishment)

It is Christmas season. The decorations are hung or need to be. Gifts are being purchased. The Advent Week of peace is being celebrated. Parties are being thrown. And Americans wind down from a long, stressful year.

Unfortunately, while most Americans refocus, the rest of the world doesn’t stop, but in many cases looks at this time as an opportunity to exploit.

Read MoreCommentary: The Fed’s Interest Rate Hikes Have only Destroyed $398 Billion of the $6 Trillion It Printed

“Our expectation has been we would begin to see inflation come down, largely because of supply side healing. We haven’t. We have seen some supply side healing but inflation has not really come down.”

That was Federal Reserve Chairman Jerome Powell on Sept. 21, speaking to reporters following the central bank’s meeting where the Federal Funds Rate was once again increased 0.75 percent to its current range of 3 percent to 3.25 percent in a bid to combat sticky 8.3 percent consumer inflation the past year.

Read MoreU.S. Senate Passes Massive Tax and Spend Bill Targeting Carbon Emissions, Prescription Drug Costs, More

The U.S. Senate on Sunday passed a $740 billion new taxing and spending bill that seeks to combat climate change and allow the government to control the price of prescription medications, among other things.

No Republicans voted for the bill, named the Inflation Reduction Act of 2022, in the divided 50-50 Senate, forcing Vice President Kamala Harris to break the tie. The measure must return to the House for a concurrence vote after senators passed several amendments Sunday. The House is expected to take the bill up again on Friday. If the House concurs, President Joe Biden has indicated he will sign it.

Read More‘It’s An Absurd Argument’: Economists Take Apart One of Biden’s Favorite Talking Points

The Biden administration’s oft-touted talking point that employment has boomed under the administration is misleading and instead simply a natural recovery from pandemic losses, economists told the Daily Caller News Foundation.

Facing consecutive quarters of negative gross domestic product (GDP) growth, sky-high inflation and plummeting consumer sentiment, the Biden administration has routinely cited a low unemployment rate and strong on-paper jobs creation as positive results of President Joe Biden’s economic stewardship. But the notion that these figures represent booming job creation is misleading since the economy has merely rebounded by adding back jobs that were lost during the pandemic and has still yet to reach pre-pandemic levels, economists told the DCNF.

Read MoreCommentary: Recession Predictor 10-Year, 2-Year Treasuries Spread Inverts Once Again Amid Crushing Inflation

The spread between 10-year and 2-year treasuries, a reliable indicator of incoming recessions that has predicted almost every recession in modern economic history, inverted once again overnight Monday amid financial markets turmoil with interest rates rising rapidly, the dollar strengthening and equities markets crashing.

That is almost certainly terrible news for President Joe Biden and Congressional Democrats ahead of the 2022 Congressional midterms. The White House has attempted to highlight relatively low unemployment numbers as signs of a healthy economy, with President Biden on June 3 declaring the latest jobs numbers as “good news.”

Read MoreGeorgia Lawmakers Approve $30.2 Billion Budget as 2022 Session Draws to a Close

Georgia lawmakers capped off the 2022 legislative session by approving the state’s fiscal 2023 budget.

The state Senate voted 53-0 in favor of House Bill 911, while the state House voted 160-5.

The $30.2 billion budget, which starts July 1, represents a 10.8 percent increase over last year’s budget and includes a $5,000 pay increase for state employees. Coupled with more than $17.6 billion in federal money, the state’s budget exceeds $57.9 billion.

Read MoreHouse Passes Democrats’ Social Spending Bill After Congressional Budget Office Score

Congressional Democrats passed a $1.75 trillion social spending plan Friday, putting the bill’s fate in the hands of a deeply divided Senate.

The bill funds universal pre-kindergarten, climate change spending, Obamacare subsidies, an extension of the monthly child tax credit payment and more wide ranging spending items. House Republican Leader Kevin McCarthy spoke more than eight hours on the House floor overnight to delay the vote until Friday morning, but afterward it passed 220-213 along party lines with one Democrat opposed.

“We are very excited for what it does for the children, for the families,” House Speaker Nancy Pelosi, D-Calif., said in a press conference after the bill’s passage.

Read MoreSenate Republicans Filibuster Government Funding Bill Over Debt Ceiling Provision With Three Days Until Shutdown

Senate Republicans Monday filibustered Democrats’ bill to fund the government and suspend the debt ceiling, days before a potential federal shutdown and possible debt default.

Republicans vowed for weeks to oppose a debt ceiling increase and urged Democrats to put the provision in their filibuster-proof $3.5 trillion reconciliation bill. But Democrats have thus far refused to do so, and with their bill’s failure Monday, Congress now has just three days to pass a new funding bill to avoid a government shutdown set to begin Friday at midnight.

Read MoreThe Congressional Budget Office Says the Bipartisan Infrastructure Bill Will Increase Deficits by $256 Billion over 10 Years

The Congressional Budget Office estimated Thursday that the bipartisan Senate infrastructure bill will add $256 billion to the deficit over the next decade, undercutting its backers’ claims the spending had been offset.

In FY2020, the deficit hit a record $3.1 trillion. So far in FY2021, the deficit is $2.2 trillion. The national debt is climbing to $29 trillion for the first time in U.S. history.

Read MoreU.S. Set to Hit Debt Ceiling Within Four Months, Congressional Budget Office Estimates

The federal government is on track to reach the statutory debt limit in the fall, which would trigger a government shutdown, according to a Congressional Budget Office (CBO) estimate.

The U.S. is projected to reach the debt ceiling of $28.5 trillion by October or November, a CBO report released Wednesday stated. If Capitol Hill lawmakers don’t reach an agreement on raising the limit higher, the government could undergo its third shutdown in less than four years.

“If the debt limit remained unchanged, the ability to borrow using those measures would ultimately be exhausted, and the Treasury would probably run out of cash sometime in the first quarter of the next fiscal year (which begins on October 1, 2021), most likely in October or November,” the CBO report said.

Read MoreCalifornia Spent $13 Million to Guard 120 Empty Homes

The state government of California has been revealed to have spent $13 million on providing security for 120 empty houses for five months, even as a homeless crisis ravaged the state, Fox News reports.

In a report broken by local outlet Fox 11, the California Department of Transportation (CalTrans) paid $9 million to the highway patrol from November 2020 to April 2021, and gave another $4 million to a private security firm over the same period, all for the purpose of protecting the vacant houses in Pasadena.

In a statement addressing the report, CalTrans said that the houses had been purchased by the government 60 years ago, when there were plans for a change in the local infrastructure by connecting the 710 freeway to the 210. However, that project “is no longer moving forward,” the government statement declared.

Read MoreCommentary: It is Time to Fight for the Rights of Independent Businesses

As a very young man, I was fortunate enough to start my own company out of my apartment using a small amount of investment capital from friends and family. Over time, that business grew to have over 6,000 employees and revenues in excess of $2 billion. Over nearly a 40-year span, my team and I built what some would consider a remarkable track record, as measured by both sales and profits.

Because of my experience growing that business, I feel a special kinship with small, privately owned businesses and their owners. I also come from a middle-class background, one that shaped me into the person I am today. It is through both the lens of entrepreneur and member of the middle-class that I look through when reflecting upon this Independence Day.

Read MoreCommentary: Price Stability, not Inflation, Will Get the U.S. Economy Back to Full Employment Sooner Rather than Later

2020 and 2021 are two sides of the same coin: Price instability brought about by the dollar being either relatively too strong or too weak, which can lead to or exacerbate economic slowdowns, creating higher unemployment and worse if the conditions persist for too long.

In 2020, at the height of the Covid pandemic, the problems included the global economy being shut down plus local lockdowns resulting in a massive recession and a flight to safety into U.S. treasuries as interest rates collapsed, making the dollar too strong. With the onset of deflation, consumer prices plummeted in March and April 2020, with oil even dropping briefly below zero dollars for the first time in history, and a concurrent rise of unemployment as 25 million Americans lost their jobs.

Read MoreBiden’s ‘American Jobs’ Plan Could Cost Taxpayers about $666,000 per Job Created

President Joe Biden’s proposed $2 trillion American Jobs Plan could end up costing taxpayers more than $666,666 per job created.

The Washington Post gave Biden “two Pinocchios” for saying the American Jobs Plan, his infrastructure and jobs proposal, will create 19 million jobs. Both Biden and his Transportation Secretary Pete Buttigieg have made the 19 million jobs claim. The source of the statement is a Moody’s analysis, which CNN pointed out had estimated the U.S. economy would add about “16.3 million jobs over the same period if the infrastructure proposal does not get passed.”

Read MoreNew House Rules Carve-Out for ‘Climate Change’ Bills Exempted from Requiring Projected Price Tag

House Democrats blocked a Republican attempt on Monday to require any proposed climate change legislation to also include its projected cost.

Under the Pay As You Go (PAYGO) rule, any additional government spending proposed must be accompanied by tax increases or separate cuts. After a push from several lawmakers in the Democratic Party’s progressive wing, however, the rules package for the 117th Congress states PAYGO will not apply to legislation relating to the necessary economic recovery or U.S. efforts to combat climate change.

Read More